Top US telecommunications organization modernizes finance architecture while complying with a challenging new regulatory standard

Learn moreAbout our client

With over 65 million subscribers, this telecommunications organization is one of the largest in the US.

Innovative offerings and a commitment to customer service have resulted in rapid growth over the last five years.

Company controller

faces a twofold challenge

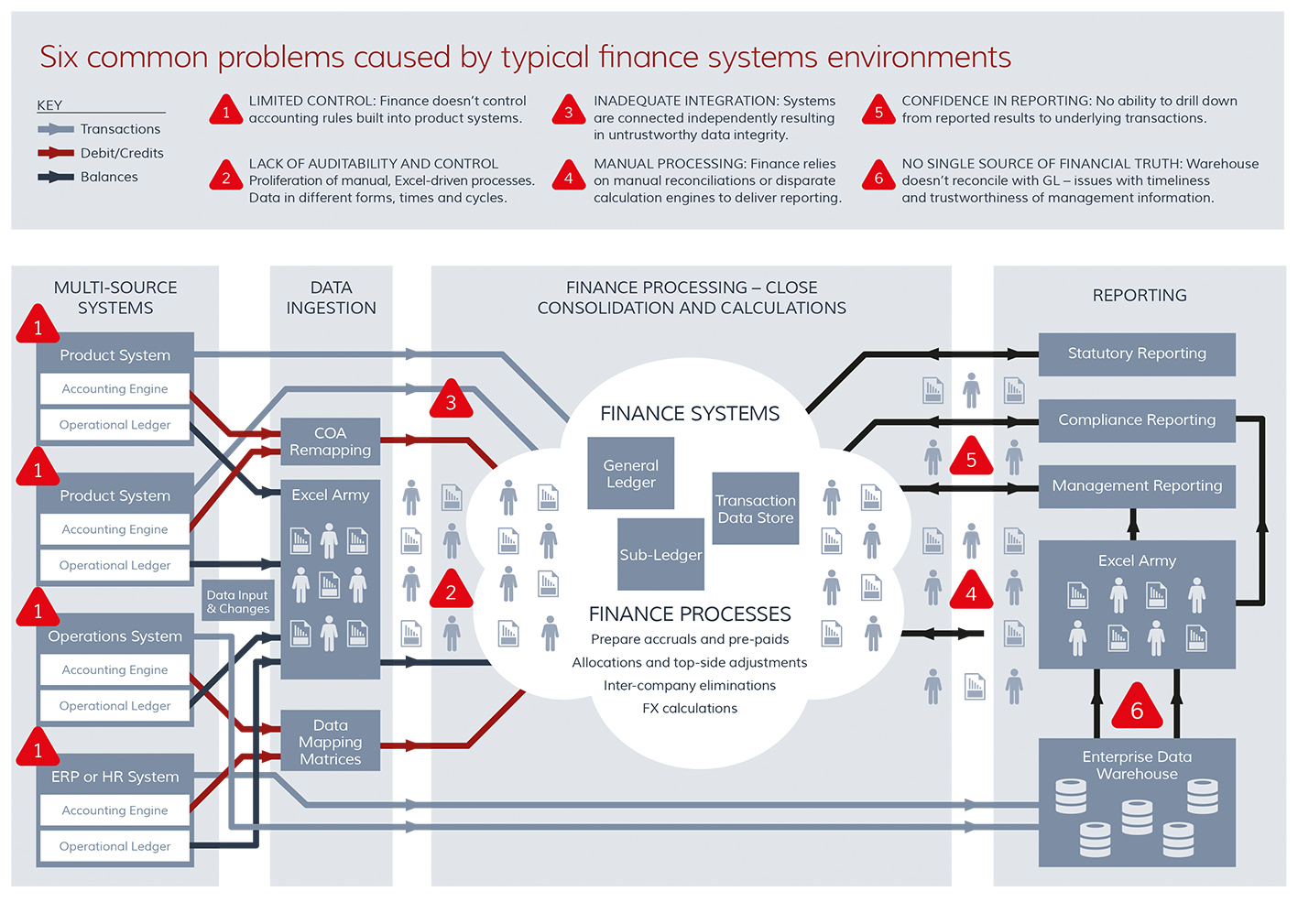

Create a Modern Finance IT Architecture

Spending too much time on manual data integration and accounting tasks was preventing the finance department from adding more strategic value.

They needed a high performance solution to automate accounting, speed-up close processes and give finance a golden source of reconciled data.

Comply with the new Revenue Recognition Standard

To achieve compliance with the new standard, they had to access granular, contract level detail for all contracts with customers.

They would then need to define and apply complex revenue recognition rules to address hundreds of accountings scenarios, generate the required accounting and deliver required information to reporting systems.

The Vision

A flexible, high-performance solution to support complex accounting, business innovation and compliance with the new revenue recognition standard.

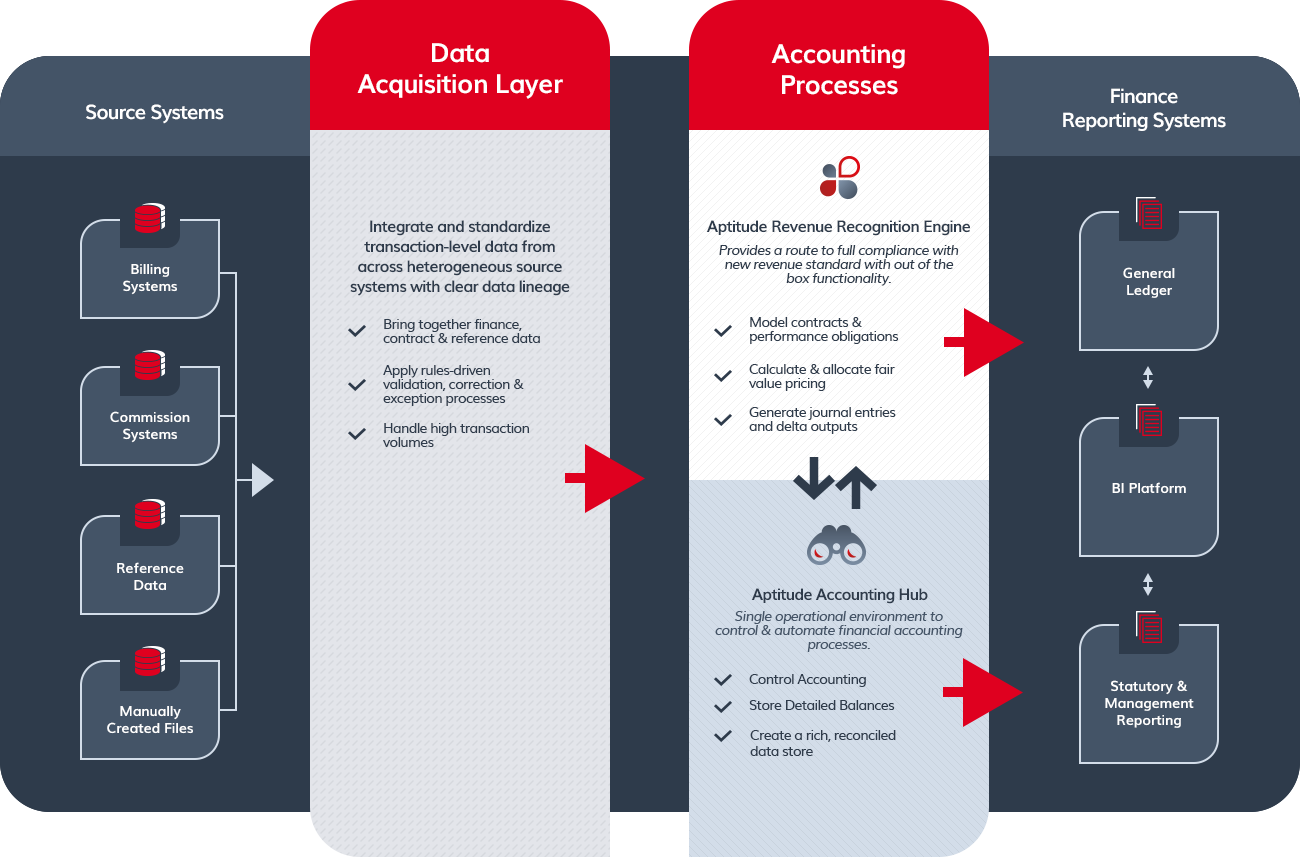

At a high level, the solution needed to:

- 1 Integrate and standardize data from new and legacy systems

- 2 Enable business users to define and flexibly control rules-based accounting logic

- 3 Deliver best in class performance to handle high transaction volumes

It's important to be able to take data all the way through the accounting process within a strong control environment. Our goal is to put in automated, integrated systems that limit manual processes and mitigate risk. We want the systems to do the work, rather than people.

The Aptitude Team

Martin Redington

Aptitude Software CTO

From the start, the company controller felt the Aptitude Software team was talking the same ‘finance-driven’ language and could clearly articulate accounting policies and financial reporting requirements.

The Solution

The Aptitude Software solution combines a powerful data integration and standardization layer with our packaged Accounting Hub and Revenue Recognition Engine

This will give the organization a single version of financial truth along with the flexibility and processing power to control accounting, support innovation and address future challenges.

The Aptitude Software solution delivers the following benefits

- 1 Provides a single finance hub with a detailed Sub-Ledger that enables the business to unlock new insights

- 2 Handles extremely high volumes of transactions & contract parts and generates the millions of journal lines required

- 3 Leverages accounting templates and 300+ revenue recognition scenarios to reduce implementation time and risk.

- 4 Positions the organization for ASC 606 compliance and future regulatory changes

- 5 Gives business users control of financial accounting, reducing the burden on IT

Learn more about the products

Moving Forward

The finance team now has the finance architecture in place to allow them to:

-

Increase time spent on higher value activities

Increase time spent on higher value activities

-

Use validated data to strategically guide the business

Use validated data to strategically guide the business

-

Respond with agility to current & future requirements

Respond with agility to current & future requirements