Large Global Reinsurer tackles complex accounting and reporting requirements

Learn moreAbout our client

A division within one of the world’s largest reinsurers had proudly evolved their business to create value for external and internal stakeholders.

However, the business had evolved faster than the capacity of the finance infrastructure and this was holding back growth.

The organization wanted a solution that would give the finance team enhanced automation and control over all aspects of the finance process - data integration, calculations, accounting, reporting and so on – a global and integrated finance IT landscape to support sustainable growth.

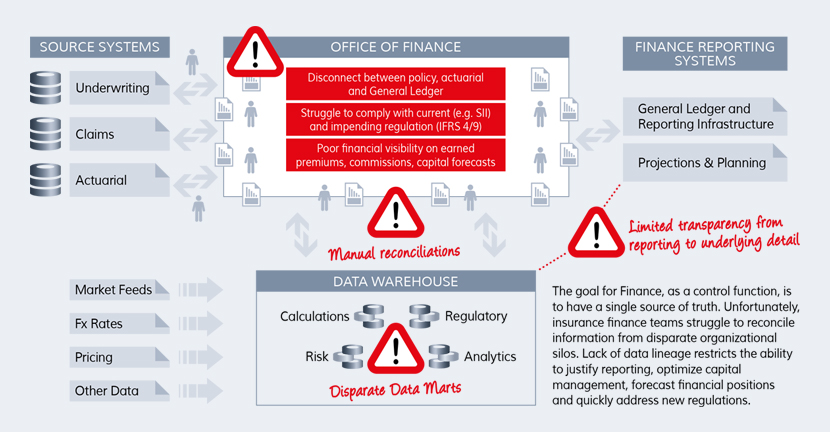

The Challenge

In order to ensure Finance IT was able to support and enable the business, the solution would need to address two key challenges:

Address the need for a streamlined valuations process

- Like all insurance organizations, the company must constantly re-value insurance contracts on their books based on market and other changes. Old systems required them to perform valuations sequentially which slowed the process and created dependencies.

- Couldn’t see the drivers for change in valuations at the policy level or allocate top down adjustments to policy level granularity.

- Didn’t have timely, accurate data for analysis at a granular level.

Support Complex Accounting and Reporting Requirements

- Actuarial teams posted adjustments directly to the General Ledger to reflect valuation changes for policy portfolios which meant finance did not have an audit trail or a single version of financial truth.

- The business had to settle for a quarterly close due to systems requiring a sequential close.

- Complex agreements required for retrocession could not be accounted for using existing systems.

- Existing systems would likely not be able to address upcoming significant regulatory changes.

Why they selected Aptitude Software

Aptitude Software was chosen to support the organization’s need for a calculation engine and a centralized Accounting Hub in direct competition with one of the largest technology vendors in the world.

- 1Articulated a broader Finance IT architecture with tight product integration

- 2Able to deliver the solution within a short time frame

- 3Collaborated with and earned the trust of both technical and business user groups

- 4Delivered significant amounts of insurance functionality (including currency translations and handling multiple GAAPs) compared to competitors who were unable to complete many of the scenarios provided

- 5Demonstrated the ability to handle complex scenarios including multiple levels of reporting, varying valuation methods and retrocession

The Solution

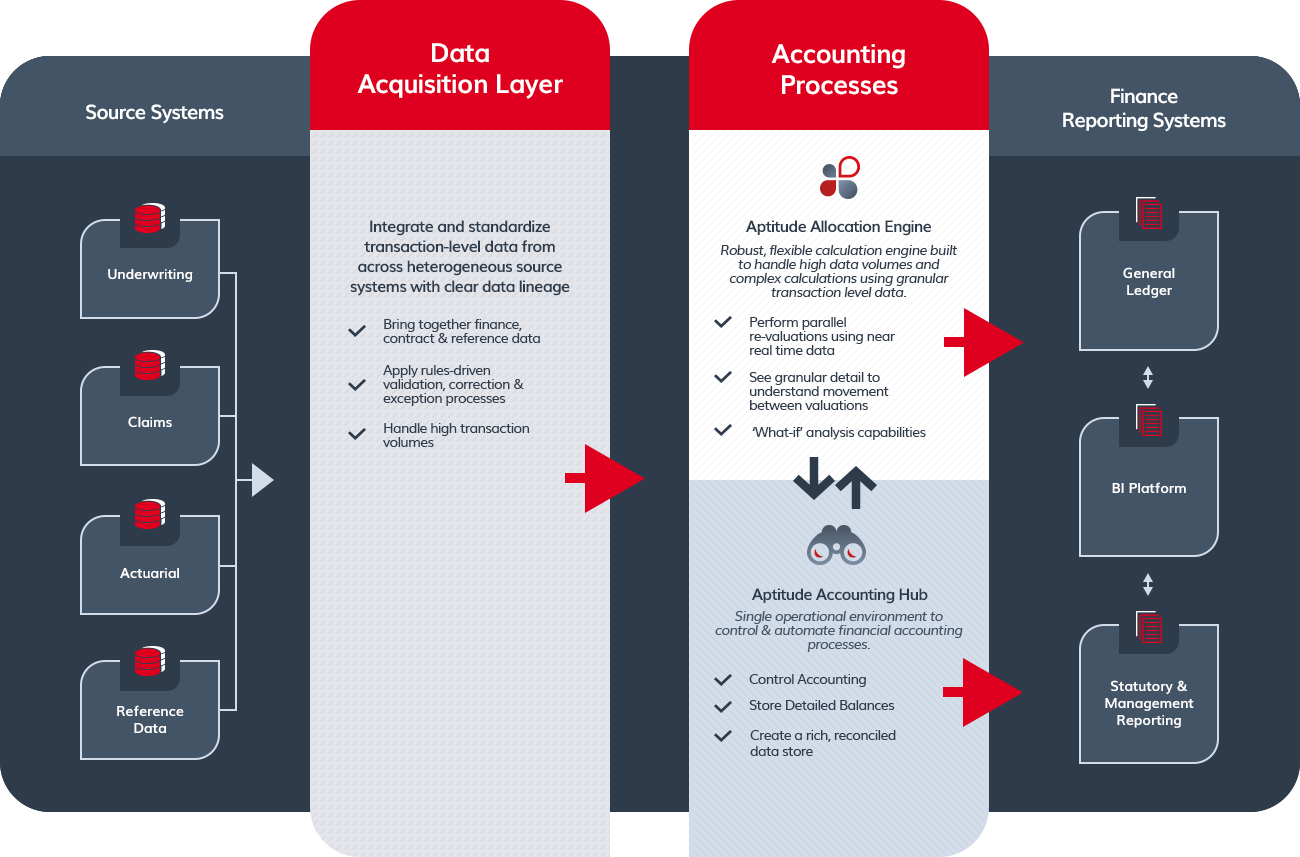

The Aptitude Software solution combines a powerful data integration and standardization layer with our packaged Accounting Hub and Allocation Engine

The combination of a flexible calculation engine (AAE) working with the Aptitude Accounting Hub delivers a fully integrated financial processing architecture with front-to-bank data lineage.

Once implementation is complete, the Aptitude Software solution will deliver the following benefits:

The Aptitude Software solution delivers the following benefits

- 1 Centralized solution to complete detailed trial balance processing across 3 different GAAPs

- 2 Run premiums through an entire life-cycle based on different events

- 3 Address retrocession by modelling the assuming and seeding of risk by different entities and generating required accounting

- 4 Provide a Sub-Ledger with trial balance information and debit/credit integrity ('ledger certified drill down.’)

- 5 Perform parallel re-valuations based on near real time currency exchange rates as well as current regulatory and reporting requirements

- 6 Understand the movement between valuations, gain drill down capabilities and increase auditability