Key Takeaways

- The OTT market will continue to grow in 2021, surpassing Pay TV

- Where Amazon, Netflix and Hulu will see saturation, Disney+ may continue to see gains, and new players are entering the market with high hopes

- Smaller or more niche OTT providers will likely need to aggregate to win a slice of household entertainment budgets with variety, value and local relevance

- BVOD was forced to grow in 2020, and will thrive for the first half or 2021, possibly seeing declines beyond global COVID vaccinations and the reopening of large-scale venues

- Live sport broadcast will continue to adapt with VR and AR improvements

- Ad spend will bounce back to take advantage of continued rises in subscriber numbers

- Churn will remain a challenge

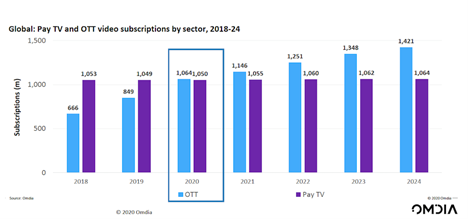

1. OTT Overtook Pay TV in Demand in 2020, and Will Continue to Rise

2020 was the year of OTT, with consumers seeking out digital entertainment in the stay-at-home ecosystem and the ‘new normal’ is going to continue to drive demand. In fact, this year has seen subscriptions to OTT services surpass Pay TV, with the trend likely to continue, as OTT subscriptions are expected to rise further by 7.71% during 2021. Disney+ aimed for 90m subscribers by 2024, and managed to meet that target in just eight months. New services are hoping for similar success, including CBS All Access (Paramount+), Discovery+, and Peacock from NBC Universal.

Source: OMDIA

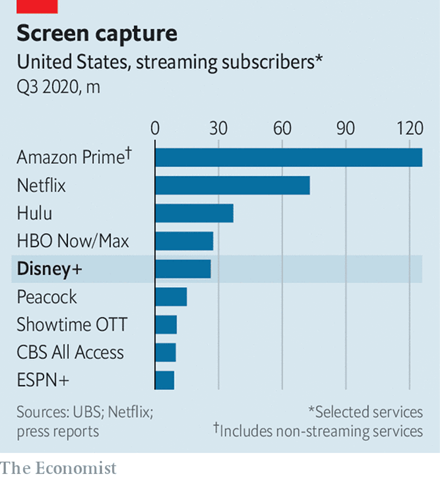

2. Are we Hitting Subscription Saturation Point?

The subscription model is everywhere and extends far beyond the boundaries of OTT streaming. Wallets do not, and consumers are being faced with budget decisions on everything from TV to homewares. In 2020, the consideration of how many subscriptions were too many was a hot topic, and still is. The Big Three – Netflix, Amazon Prime Video and Hulu, have seen their growth slow, as Disney+ reclaims rights to its content, and consumers find their favorite shows now spread across multiple platforms. As other studios and rights holders aim to seek to launch their own services, how many services will customers be willing to purchase?

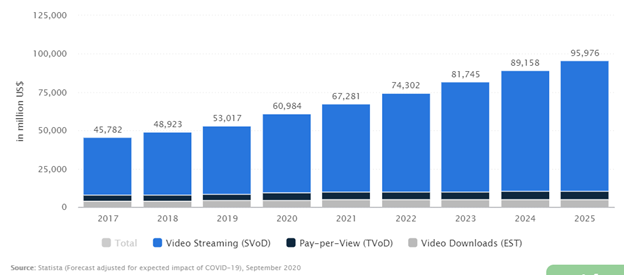

Despite this, OTT growth is predicted to continue well into 2025 and new services such as Apple TV and Disney+, have the potential to change the order of the Big Three.

Source: Statistica

Source: Statistica

3. Aggregation on the Horizon

With the prospect of OTT fatigue discouraging customers to subscribe to new services, broadcasters will need to start working together to aggregate services. The BBC and ITV in the UK have Britbox. Germany’s Joyn started off as a standalone streaming service before partnering with Discovery, as well as supporting a number of other German channels. Smaller studios and vendors, unable to match the subscription numbers of Amazon and the growth of Disney+, are likely to move towards a more cooperative approach.

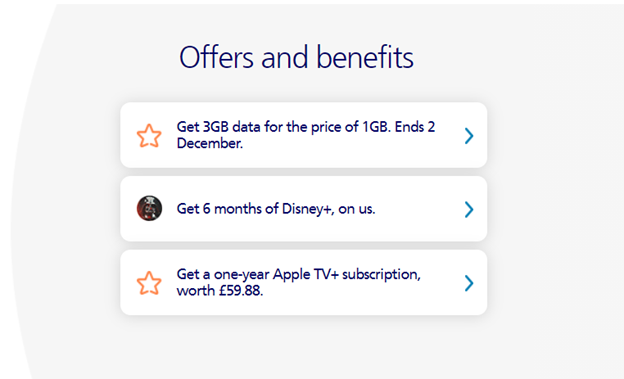

Another emerging trend likely to continue is the ‘bundling’ of OTT and SVOD subscriptions with other services. O2 currently offers 6 months of Disney+ and Apple TV+ as part of some mobile phone tariffs.

Google also appears to be working on an aggregator app built into Chrome, called Kaleidoscope, though there are no guarantees this project will become widely available to users, which is thought to support Netflix, Amazon and Disney+ as an authentication aggregator rather than a direct partnership between the three services.

Google also appears to be working on an aggregator app built into Chrome, called Kaleidoscope, though there are no guarantees this project will become widely available to users, which is thought to support Netflix, Amazon and Disney+ as an authentication aggregator rather than a direct partnership between the three services.

As more and more OTT services enter the market, and rights move around, demand for aggregators will increase as consumers try to work out which services are right for them. There’s a definite gap between entertainment news sites, and aggregators, that would guide consumers to create the right DIY bundle of services for their needs.

So, while a single aggregator that grants access to the major OTT platforms is unlikely in the short term, the threat of competitors banding together to take their crown might force a change of strategy further down the line.

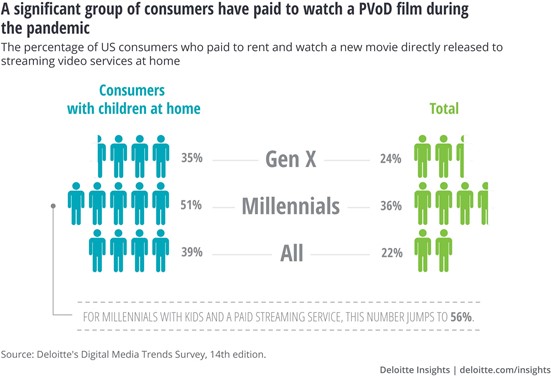

4. 2021 Could be the Year of PVOD

Premium Video On Demand (PVOD) – the delivery of content outside of the typical subscription offering and traditionally sports-led – is a growing market, with 22% of US streaming customers paying to watch a direct-to-service movie in 2020 due to the closure of cinemas globally. Universal Pictures have seen success from releasing movies directly to digital, such as the release of Mulan in September. However, with more than 60% of Millennial and Gen X viewers reported to be willing to watch a film in the cinema in the next six months, widespread PVOD services are more likely to become a competitor to, rather than a replacement of, the cinema experience.

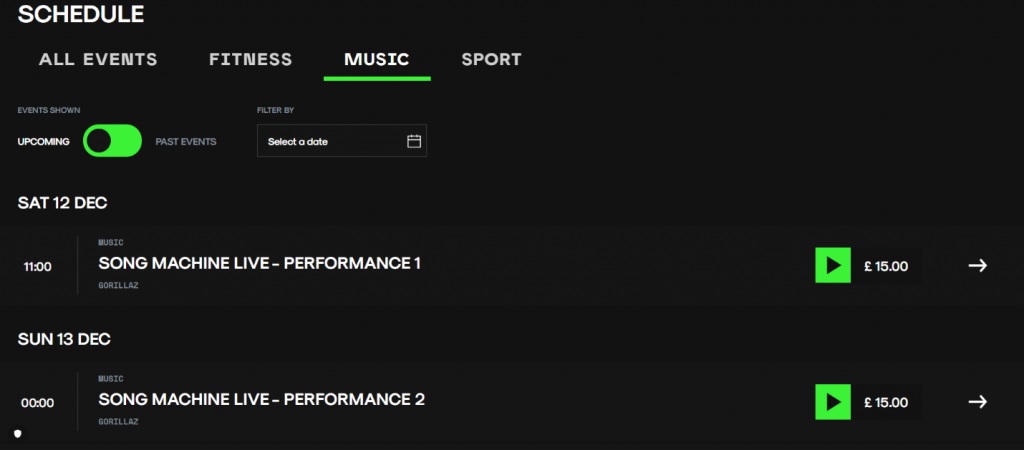

5. Event Streaming on Demand will Continue to Rise

While live sport has returned, the live experience has not, and 2020 has seen sports broadcasters look to be more creative with their content. Live streaming events were already increasing in popularity but with large crowds likely to be the last restriction that is lifted, the trend is set to continue for the significant part of 2021. Content will become more technically creative, with player interviews, more access for cameras in places like dressing rooms, and simulated crowds.

With broadcast rights becoming more fragmented across OTT platforms, sports fans may have to choose their team or club preferred provider or seek to subscribe directly to the streaming offering of that team or club directly. Music events promoters are also seeking new ways to create revenue streams in the ‘new normal’, and live streaming is gaining popularity as a result. LiveNow, originally a sports service, has branched out to music and entertainment, hosting very successful live music concerts for fans. Their recent Dua Lipa concert reached over 5 million viewers, breaking records for live-streamed concerts. Teatrix, an Argentina-based VOD provider, is seeing similar success. For 2021, live-streamed events are a given, rather than a prediction, and Virtual Reality live sports streams are already available. Capitalizing on this technology for live events is likely to provide a long-term revenue stream beyond the pandemic as a new and more immersive way for fans to experience content.

Source: LiveNow

The ad investment in OTT is likely to continue to grow, with spend focused on OTT and SVOD services as well as live sport and gaming.

6. 4K will become the ‘standard’ Proliferation of 4K could be accelerating the demise of Pay TV

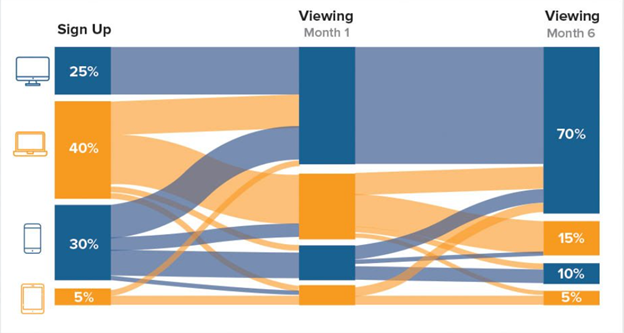

21% of all TVs in use will be 4k by the end of 2020, compared to just 0.01% of smartphones/tablets. Lower resolution content will continue to be the standard for mobile for a while, whereas 4K will overtake HD as the standard for TV. OTT services have a clear technical advantage Cable/STB services in serving this need, which will further drive the shift towards OTT and opening additional opportunities. 2020 has already been the worst year on record for Pay TV ‘cord cutters’, with eMarketer reporting that by 2024, more than a third of US homes will have canceled their Pay TV services, bringing the total of cord cutters to 46.6 million. The trend is a 7.5% drop year on year, which is presenting huge opportunities for OTT services with the right content offered at 4K streaming resolution.

Percentage of subscribers signing up, viewing initially, and viewing generally by device (source: financesonline.com)

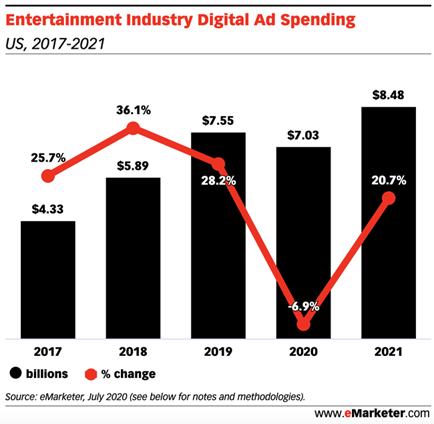

7. Ad Spend Will Surge on Streaming Video

Marketers across the board are gearing up for a big push in 2021, and ads in streaming video are a huge market. Following a 6.9% decline in digital ad spend in 2020, the prediction is that this will jump to 20% in the coming year. With the predicted shift from Pay TV to streaming previously mentioned, advertising is following the trend. Those households that are cutting the cord are opting for DIY bundling, opting for a combination of premium and specialized SVOD and several AVOD services. This gives the opportunity for advertisers to target demographics based on the audiences of these services and focus their spend. OTT providers may find that identifying and specializing to these markets can increase ad investments as a result.

8. Consumers Have More Choice than Ever Before, Which Could Drive Churn

Parks Associates reported that churn in streaming services rose to 41% during the first quarter of 2020 from 35% in the same period of 2019. Content fragments across services, rights are transferred, new shows for SVOD services go exclusive, sports rights are divided between services, and original content is exclusive. All these factors contribute to subscribers with itchy trigger fingers, ready to churn and move to the next service. Of course, this could also mean the same customers come back for their favorite shows, but it will become more and more difficult for major SVOD services to retain their customers for long periods of time. Specialized, niche services may find that customers can be retained more easily by service their niche, but all providers will need to ensure they can move quickly to re-engage customers when a competitor launches content that is likely to be in high demand.

Summary

2021 is not going to be the ‘back to normal’ year; even at best estimates, the first half will likely mirror 2020 in terms of consumer habits. The OTT environment will change substantially as providers have had almost a year’s opportunity to read the crowd, adapt, and develop and release new methods of reaching their audience.

Churn will be a major challenge. The fragmentation of content across more OTT services alone will mean customers will be basing their subscription choices on their favorite content and will happily churn and re-subscribe as they move between services month-by-month. Retaining customer loyalty will require great data analysis, serving the right content at the right price.

While the digital transition has been difficult for sports and live events, the opportunity to create new revenue streams and serve customers in new ways lasting far beyond the pandemic cannot be ignored. OTT providers that innovate, will lead.

If any of the topics in this blog resonated with you, and you’re looking for new ways to gain new subscribers, download our brand-new playbook “OTT Subscriber Acquisition Strategies for a New Reality” in the form below.

We’re here to help

If you are reviewing your OTT strategy, get in touch to arrange a demo of how we can unlock all the tools needed to succeed now, and in the future.

Contact our helpful team; Telephone +44 844 873 1418 or visit our contact us page.