Recently we joined up with Deloitte to host an IFRS 17 round table event in Sydney. We were joined by finance leaders at seven insurers across the Life, General and Reinsurance space. The discussion was lively and touched on the wide range of challenges and opportunities presented by IFRS 17 and the attendee’s project learnings so far.

Key Topic Areas

The event covered – among other things – IFRS 17 accounting model challenges, best practices for designing a program approach, transitions and change management.

During the program, Aptitude client AMP Limited, presented some of their key project learnings followed by a roundtable discussion that gave participants a chance to voice their thoughts and add color to the discussion. An interactive Q&A helped gauge perspectives and project progress of the room.

“The event demonstrated that a collaboration between client, software vendor and industry experts can be very powerful to understand and manage one of the biggest changes in the insurance sector in the last 20 years,” observed Marty Engel, Partner & Aptitude Alliance lead (AUSTRALIA) at Deloitte Consulting.

Top 4 takeaways from the event

Program approach best practices are emerging.

The group shared various program management practices that are helping them successfully navigate challenging projects. Tips included establishing a cross-functional working team prior to vendor selection to ensure early buy-in and holding regular, short ‘stand-ups’ like those used in agile development. Other participant tips included:

- Focus meetings on actions and required decisions rather than status updates.

- Maintain strong ties between working groups as changes made in one area will have ripple effects.

- Waves or short sprints can allow for flexibility in team size, skill sets, and partner engagement which can help tackle complexity.

Having access to granular data is critical to project success.

The idea that “aggregation is always easier than dis-aggregation” was a common theme running through the session. Attendees recognized that many current processes are all built around accounting aggregations which will need to be stripped down to a more granular level of detail to comply with the new standard. Having data at a granular level also makes it cleaner to split actuarial and accounting and enables future flexibility.

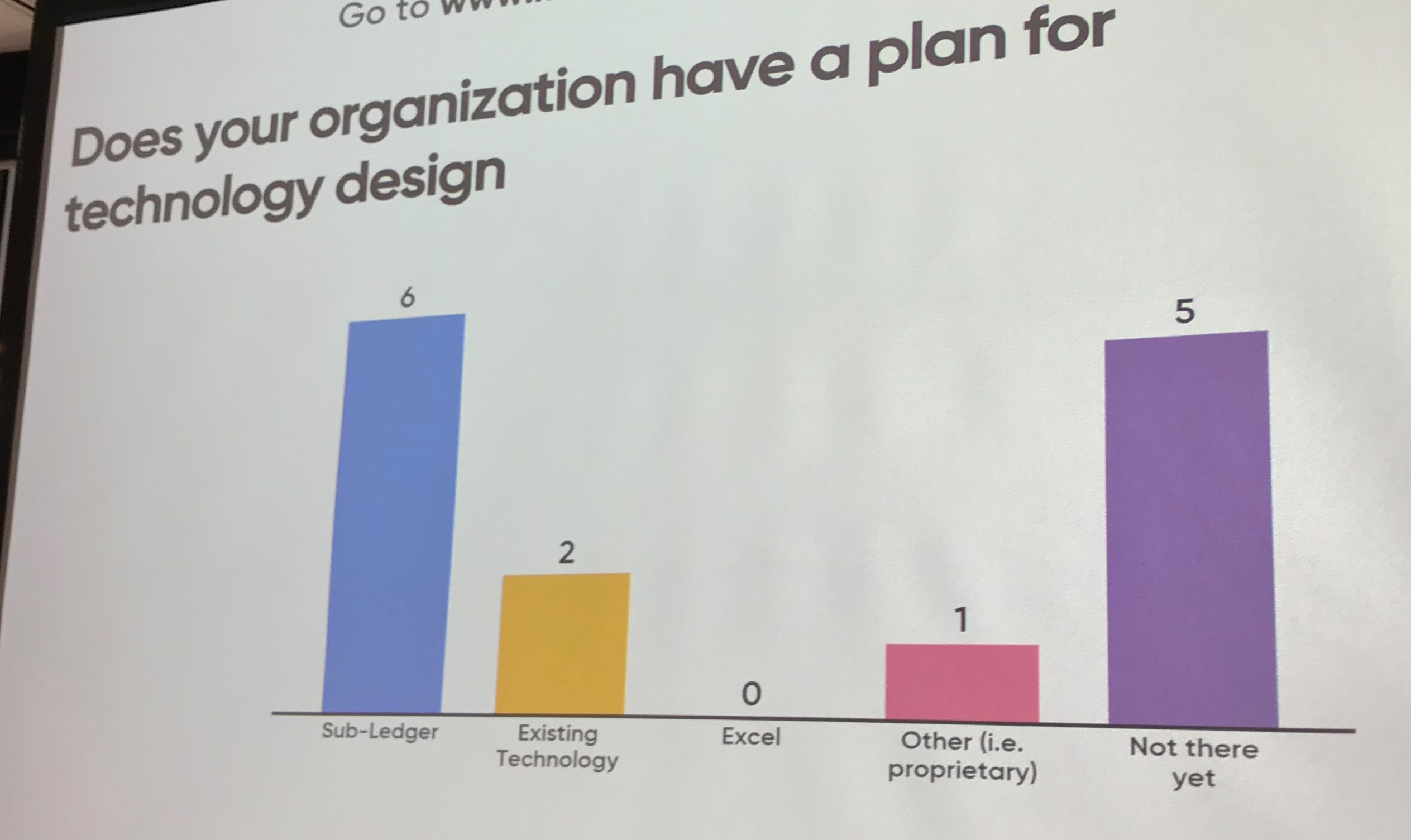

Subledger approach as the solution of choice.

For those attendees who had already made a technology decision for IFRS 17, using a subledger was the overwhelming solution of choice. Participants cited using subledgers to address reinsurance linking requirements, simplify actuarial modeling, and provide a starting point for an IFRS 17 chart of accounts. For IFRS 17, subledgers can also:

- Make movement analysis much easier

- Handle all the complexities of consolidation – e.g. different CSM, inception discount rates, expenses, grouping, PVs etc.

- Make it easier to create alternative views for APRA/ATO

- Enable a thin Group Ledger with drill back capabilities into the subledger

“A subledger provides a solid foundation for using transaction, contract and reference data at the most granular level of detail – providing agility and robustness. It enables a clean separation of accounting and actuarial elements and helps to simplify processes, hand-offs, and actuarial models.”

-Grant Robinson, Senior Actuary – Head of Actuarial, Projects & Support, AMP Life Ltd.

Question posed to attendees:

There’s an expectation for benefit beyond compliance.

IFRS 17 is a significant change and most insurers want and expect to get value out of the exercise – above and beyond the minimum functionality necessary to achieve compliance. During the event, potential areas of benefits discussed included:

- ·Cleaner processes with less manual workarounds

- ·Reporting improvements that drive business value

- ·Consolidation of data sources and elimination of data silos

- ·Ability to simulate what-if scenarios using detailed data

Moving forward

As IFRS 17 projects march forward, our roundtable participants are challenging their business to understand what value can be delivered above and beyond compliance. Insurers are recognizing that having a strong solution in place can not only reduce IFRS 17 project complexity but also allow the organization to respond to future business change. For more information on the topics discussed or to join the next roundtable event, please reach out to Adam Flowers, APAC Regional Sales Director at: adam.flowers@aptitudesoftware.com.

About Aptitude Software

Aptitude Software is dedicated to helping its clients transform their finance departments, support regulatory compliance and deliver a future-ready platform. They are currently supporting large enterprise clients across five continents and in over 42 countries. Aptitude was recently named one of the Top 10 Corporate Finance Tech Solution Providers by APAC CIO Outlook.