We had the pleasure of hosting three recent events last month in London, Sydney and Melbourne which gave us the chance to discuss and debate AI-Powered Autonomous Finance with our expert panelists and attendees. In this brief round-up blog, we highlight some of the insights and topics that were covered. Hope you can join us at our upcoming events in New York and Toronto!

London

We had a full house for a half day session at the Microsoft offices in London. We kicked off the session with Mark Aubin, SVP of Product and Market Engagement, providing the first look at our Autonomous Finance Benchmark Research. This research included insights from over 1,700 Finance professionals as well as deep dive conversations with 10 global CFOs. Check out our video sneak peek of the research results!

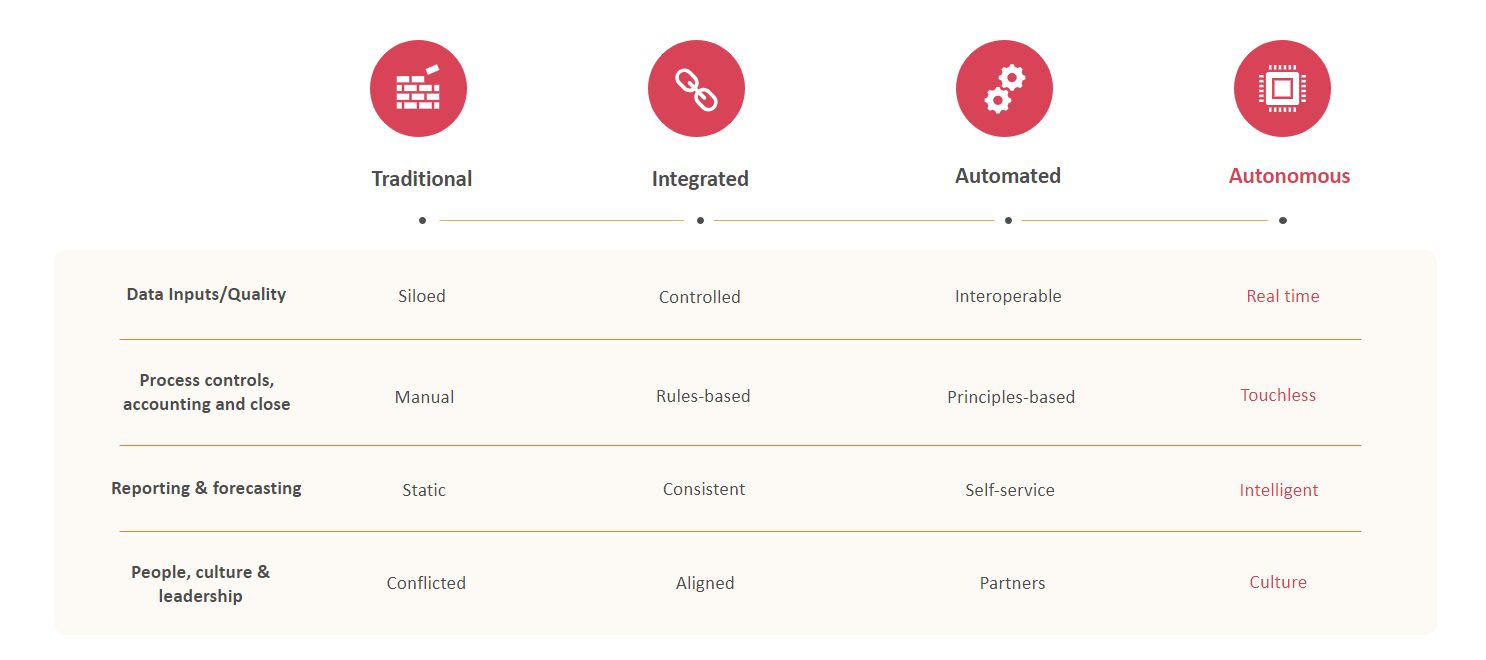

In addition to uncovering trends in areas like finance challenges, opportunities, automation and AI usage, respondents also answered a series of questions that placed them on a continuum from traditional finance to integrated, automated and finally autonomous finance.

This allowed us to see not only where the majority of teams are in their modernization journeys but also how these journeys differed by region and sector.

Panel Insights: Art of the possible for CFOs

After Mark shared the results of the research it was time for our panels. First, we welcomed the following panelists for a discussion about the art of the possible for CFOs:

- Anat Katz-Arotchas, ERP Strategy Lead, Microsoft

- Tobias Menzel, Director Financial Services, HSO

- Brenden Tsang, Finance Transformation Partner, KPMG

Insights included:

Focus on efficiency and effectiveness: Tobias emphasized the importance of finance teams focusing on doing the right things rather than just doing things right, or a combination of both, to achieve efficiency and effectiveness. “Autonomous finance and AI will help to get the finance staff members focused on doing the right things from my perspective…to spend more time on value-adding activities.”

The time to start experimenting with AI was yesterday: Anat quoted a Gartner stat that stated that by 2026, organizations that have three or more years of AI experience would be twice as productive as organizations that don’t have that experience. “The recommendation is definitely that everyone needs to start today – or even yesterday – because it’s a new technology, you need to learn how it works, what it can do and build your confidence and trust.”

Transition from Excel to Power Platform: Brendan and Tobias discussed how more organizations are transitioning from Excel spreadsheets to more controlled and automated platforms like the Microsoft Power Platform. They see the Power Platform as a solution to digitize and control financial processes while ensuring compliance which can help move organizations to autonomous finance. Anat also added the fact that using generative AI and large language models to inform sequencing tasks and processing can make the Power Platform even more valuable.

Panel Insights: Finance leaders roundtable

While the first panel covered the ideal of Autonomous Finance, the second panel focused on the practical and how Finance leaders can start or push forward in their journey to Autonomous Finance.

Our panelists:

- Jon Furber, CFO, Horsefly Analytics

- Liron Rozen, Financial Controller, Microsoft

- David Chanturia, Senior Manager, EMEIA Financial Services Consulting, EY

Insights included:

Collaboration Between Finance and IT: The panelists highlighted the importance of collaboration between finance and IT departments in implementing AI and automation initiatives. They discussed how joint ownership and cross-functional teams can lead to more successful outcomes. David spoke about a successful project he worked on stating “We had engineers and finance people sitting together and very much in a single delivery organization. This made a huge difference in terms of working together, driving change, accepting change and also transitioning that team into the world was much, much easier. I’ve seen many examples where it’s either finance go off and do their own thing and they don’t consult IT. Or IT just delivers something for finance without clear end and nothing works. Then you’re in this cycle of politics and animosity which in not productive for future change. So having that alignment is very, very important.”

Quantifying Value: The panelists emphasized the importance of quantifying the value of AI initiatives, aiming for meaningful improvements in efficiency, such as the 20-25% time savings achieved in various processes.

Challenges in Adoption: Despite the potential benefits, there are challenges in AI adoption, including legacy systems, regulatory requirements, and the need for cultural change within organizations. However, there’s optimism about the increasing adoption of technology in the financial sector. Liron commented that “It’s almost like changing the way I approach daily work. To get the best out AI requires changing behavior. Before diving into certain analysis to get some insight, I try it through AI first. At first there was some some frustration but when you get some wins, then it’s like a big ‘aha’ moment and it gives you energy to to try again. You just have to really practice at it.”

Sydney and Melborne

The Sydney and Melborne attendees were treated to dinner and a round table style discussion at Aria Sydney and the Wine Cellar Room Melborne.

Matt Pisarki, Partnerships Lead in APAC for Aptitude Software, led the disussion on the benchmark results and also covered explored the ‘autonomous system architecture,’ looking at existing gaps, and exploring the innovations on the horizon. A discussion followed on where to skill up for the impending changes to the financial landscape.

Additional speakers included:

- Steve Pratley, Partner, KPMG

- Liza Richardson, FInance SME Lead, Aptitude

- Josh Grimes, Strategic Accounts Lead, Aptitude

Steve Pratley took attendees through the KPMG’s view of the Future of finance, illustrating how teams are shifting from spending the majority of their time on value protection (Reporting and Control, Financial Operations) to value creation to support increased profitability.

He also touched on the importance of ensuring Finance Transformation programs are run as a portfolio with federated sponsorship for industrializing the core and creating business value, with an equal chance on investment. Finally he presented a really interesting breakdown of the outcomes of the Future of Finance and it’s workforce, where 40% of workforce outcomes are spent on Business Partnering versus only 5% on Data and Reporting.

Thank you to everyone who joined our events, especially our speakers and panelists! Our next events will be held in NYC on May 15th and Toronto on May 16th. You can register for those events and see upcoming events as they are scheduled here.