Updated 30 October 2015 – (article originally appeared June 2015)

In July 2014, the International Accounting Standards Board (IASB) published the final version of the IFRS 9 Financial Instruments standard. Designed to replace IAS39, it introduces a new model for the classification and measurement of financial assets, a single expected loss impairment model that will require recognition of current expected credit losses (CECL), stretching to asset lifetime, and a reformed approach to hedge accounting.

The introduction of this standard is expected to significantly increase the workload across diverse functional groups such as risk and finance. As a direct consequence, industry advisors report that most banks are starting projects or are analyzing solution approaches.

Understandably, risk departments are driving IFRS 9 projects as they work to understand the impacts to P&Ls. They are needing to revise their classification and impairment models thereby ensuring that data and processes are aligned to support the new standard. However, analysts have advised that IFRS 9 compliance will also require the significant involvement of finance leaders and their teams.

The Impact of IFRS 9 on Finance Departments

The impact of the change on Finance is starting to become clear. Finance operating models will change, and the day-to-day operations will be notably more difficult as Finance need to manage the impacts of classification and impairment accounting. Challenges will also come from:

- The depth of the disclosure and reporting requirements

- The need to get closer to and understand the risk models

- The requirement to support the detail behind the valuation and provision adjustments by way of drilldown

- The need to annotate and justify the new balance sheet and income statement figures.

All of this requires a greater emphasis on the wider control environment, workflow and the ability to interrogate, adjust and provide commentary on state changes at a granular level.

Additionally, it may mean reporting two or more GAAPs during the 2017 transition year, with clear understanding of the differences to ensure stakeholder confidence is maintained. Adding to complexity, individual jurisdictions will have their own interpretations which will require global organizations to account for varying accounting treatments and potential consolidation issues. This will be exacerbated by the divergences between the IFRS and FASB stipulations, timelines and interpretations.

Much of IFRS 9 will fall to Finance departments to manage, and as such CFOs need to be looking at the following areas:

- Embedding links with Risk to understand risk models, asset classifications and measurements

- To provide the wider organization with commentary on the impacts to Balance Sheet and Income Statements

- Managing the accounting impact of the stage shift in impairment categories

- Relevant adjustments and comparative analysis stemming from Asset Reclassification

- Sign-off of management overlays to risk-based movements

- Owning the hedge accounting changes

Data and Process changes affecting Finance

The IFRS 9-based expected loss models will require data at a more granular level than has previously been required. It suggests a ‘coming together’ of risk and finance data which typically has not been fully realized in other regulatory regimes, such as Basel II & IAS39.

IFRS 9 thus may represent a golden opportunity to improve the risk and finance information architecture. What organizations must avoid at all costs is a disparate, silo’d or manual approaches to address the requirements. These approaches may not realize the full benefits obtainable by closer finance and risk alignment, and would make implementing future accounting change even more difficult.

In particular, the interface between the enhanced risk model outputs and the accounting stream is going to be increasingly important and companies will need to apply appropriate automation and control, with clear data lineage and management oversight. Finance teams may also want the ability to apply results from scenario modelling to the accounts (financial results) prior to hardening into posted state.

All of this will need to be executed without disrupting business-as-usual. One option many are considering is to apply the IFRS9 accounting as an adjusted posting to existing detailed books and records entries. This approach has the advantage of providing a clear view of the financial impact on reported financials, including management visibility into the incurred and expected loss basis, as well as delivering a compliant solution without engaging in major finance architecture transformation. Flexibility and agility without volatility are watchwords.

Other key considerations and challenges

Understand project overlap

Many organizations will see this project overlap with ongoing finance projects as well as general accounting and finance transformation work and will have included IFRS 9 implementation as a work stream within a large-scale accounting and regulatory change projects. Finance leaders should make sure they understand how they can maximize their use of precious resources and budget by looking at flexible solutions that can help meet multiple regulatory initiatives at the same time. Ideally, these solutions will also enable the business to streamline processes and access a deeper level of analytics to drive growth.

Regulators will require more than Excel

While the risk models will typically operate at the portfolio level based along risk lines, the accounting will need to be applied at the individual loan level. As loans move back and forth between impairment stages, significant movement (churn) in reported financial amounts are to be expected. It will be critical for finance teams to have a solution that provides a high degree of transparency, with the ability to explain and justify any movements at the lowest level of granularity. Spreadsheets are not able to provide the workflow controls coupled with data lineage and visibility required to support the regulation.

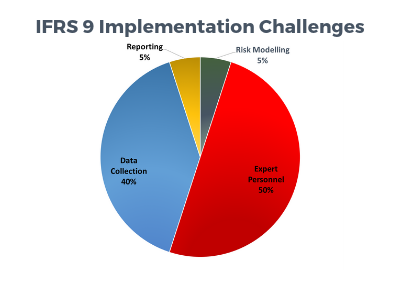

Subject Matter Expert shortages

A key stress point for banks will be resourcing. Their own subject matter experts are likely to have limited bandwidth for an IFRS 9 project. This is the case due to project complexity and the already established regulatory and finance transformation projects discussed above. Engagement with a knowledgeable external advisory and consultancy will reduce implementation risk.

About Aptitude Software

Aptitude Software brings years of finance, accounting and software domain expertise and has helped clients with countless finance challenges, including those posed by IFRS regulation. Our specialist finance solutions serve smart CFOs, empowering them to streamline processes, supercharge reporting and drive data-led decision-making. Email us at marketing@aptitudesoftware.com for more information.