“There is nothing permanent except change.” This quote is attributed to Heraclitus, the Greek philosopher born in 544 BC. Those words still resonate centuries later as we face the ever changing world in which we live.

It is no surprise, then, that the insurance industry is also changing. A shift to customer driven strategies, expanded distribution channels and heightened competitive pressures are pushing insurers to embrace technology and data to stay ahead.

Is regulation triggering the winds of change?

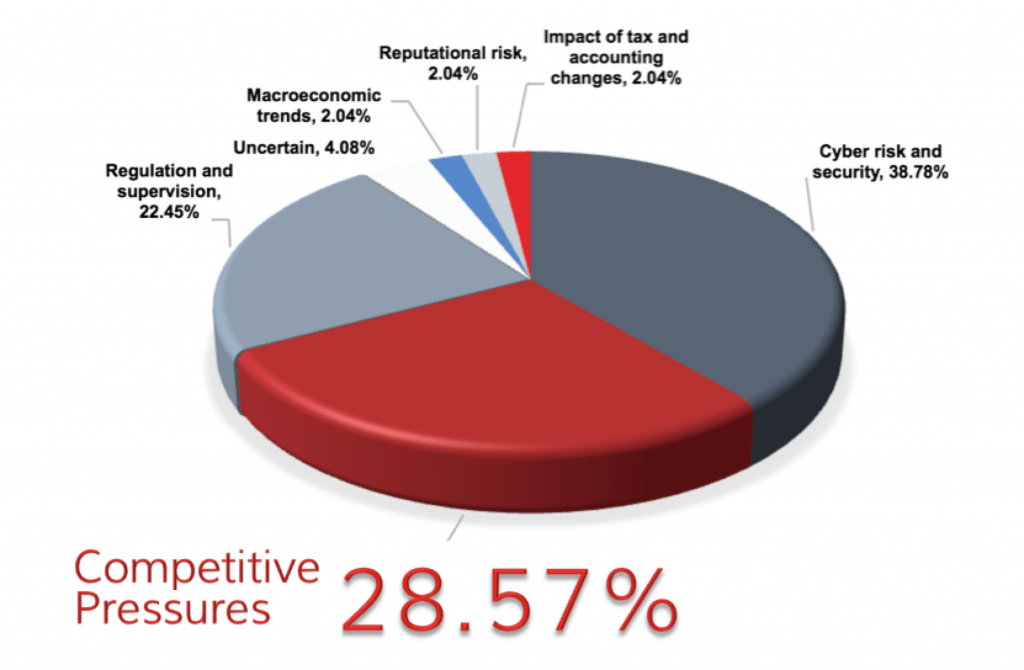

We asked respondents to identify the challenges that they are currently facing and 47% selected the changing regulatory environment, as shown in Chart 1 below. This comes as no surprise as insurers currently face the forthcoming IFRS 4 insurance accounting standard and FASB’s insurance-targeted improvements to the accounting for Long Duration Contracts. Additionally, IFRS 9 and a similar ruling expected from FASB is expected to affect insurance companies as it relates to investments subject to credit impairment accounting. All of these projected regulatory changes are expected to have a significant impact on IT systems and financial processes and controls.

Chart 1: What are the main challenges your firm is currently facing?

Note: Respondents were allowed to choose multiple answers, so results do not total 100%

Note: Respondents were allowed to choose multiple answers, so results do not total 100%Can risk create new opportunities?

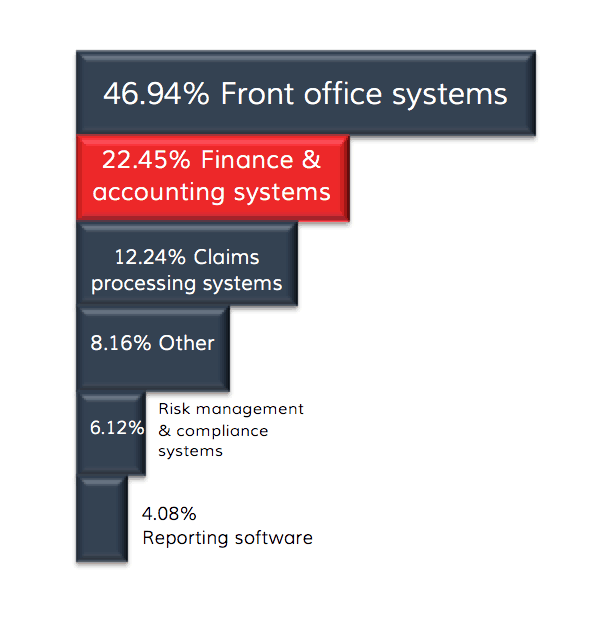

When asked what they predict will present the greatest risk in the coming 12-18 months, 38% cited cyber risk and security, followed by 28% responding that competitive pressures will pose the most risk to their firm.

In recent years, cyber risk has evolved in many areas and become not only more frequent, but increasingly costlier for companies to resolve. The effect of a cyber security breach can have a significant financial impact and result in reputational damage, greater regulatory scrutiny and loss of customer confidence. Additionally, consumers have come to expect a high level of protection for their privacy and data. Insurance companies that are able to protect critical data assets will create and maintain a competitive advantage through loyalty and insight.

Chart 2: What do you predict will present the greatest risk over the next 12-18 months?

Almost a third of respondents saw competitive pressures as the greatest risk facing their organization. In order to outperform the competition, insurers will need to prioritize developing a complete view of the customer. However, a recent study from Gartner found that “only 18% of insurers had a single view of the customer in place today, and an additional 58% of companies currently were working on building this capability out for 2016.”1

With the staggering amounts of data available, insurers can better manage their risk by using customer data to maintain a 360° view of the customer throughout the life cycle of the relationship and inform changes to products, services and customer service. Understanding granular levels of profitability — be it at an individual product, customer or channel level — will help insurers extract insight from their vast amount of data.

Will technology blaze a trail?

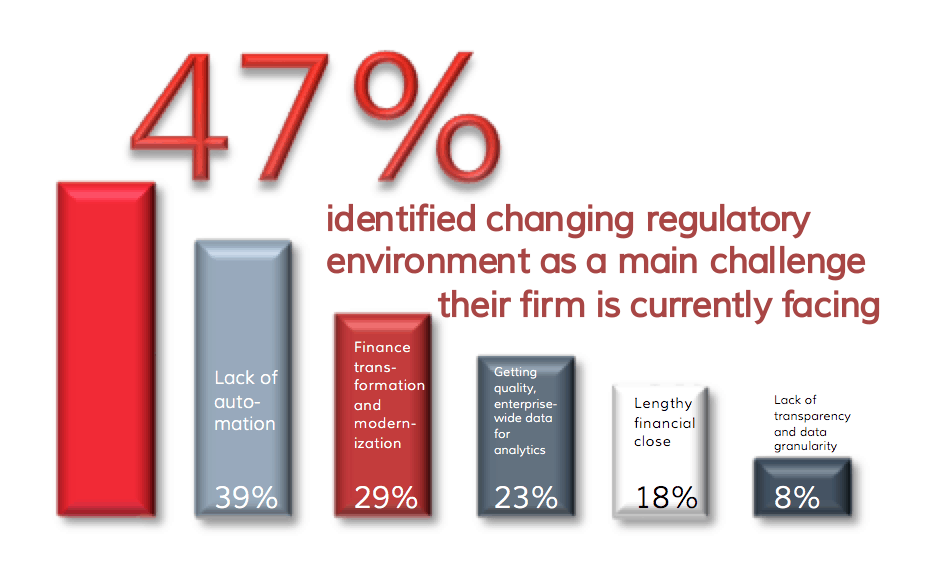

Respondents were asked where their firm will allocate the highest proportion of IT spend in the coming 1-3 years and 36.7% expect front office systems to be the focus, as shown in Chart 3. This is no surprise given the need to support the transition to the ‘customer at the core of the business’ mentioned above. Being able to rapidly close business while incorporating scale into their business, will help provide and maintain a competitive advantage. Delivering a better channel experience can further establish a firm as the carrier of choice.

Chart 3: Where is your firm allocating the highest proportion of IT spend in the coming 1-3 years?

Given the changing role of finance within insurance companies, it is not surprising to see that 22% cited finance and accounting systems as their highest IT priority. With the need to address new accounting standards, derive more meaningful insight for internal management reporting and centralize accounting controls, finance organizations require technology to help drive their business forward.

The industry is at a crossroad

Insurance companies are being challenged by the changing environment. The combined pressures from competitors, heightened customer expectations and an evolving regulatory landscape is driving firms to innovate and plan for the future. Reevaluating and updating core systems and processes to support the business will help ensure they are accessing the data needed to present a single view of the customer across all channels and lines of business. Embracing regulation, data and technology will only help the insurer in driving their business forward. Times are changing, but it is important to remember “nothing ventured, nothing gained.”

Interested in learning more? Read our short case study highlighting how the finance organization at a large reinsurer tackled their complex business requirements, saving time and costs.

1 Gartner, Research Roundup: Customer-Aligned Digitalization Will Be Challenging for Most Insurers 16, Kim Harris-Ferrante, May 2016