“Finance transformation is hot again,” according to Robert Kugel at Ventana Research.

Kugel defines finance transformation as the objective of shifting the focus of finance departments from transaction processing to more strategic activities.

Unfortunately, there are many difficult things that get in the way of transforming finance. Kugel highlights the problems of closing the books, implementing new accounting policies (like revenue recognition) or dealing with spreadsheet overload. It’s the story that all of us who work in enterprise finance know too well.

Finance have to run faster and faster just to keep up.

“A truly strategic finance organization is one that embraces continues change” – Robert Kugel, Ventana Research

Kugel advocates for uncovering the root causes of time wasting activities, addressing them methodically and investing the time saved into more strategic activities.

Finance transformation doesn’t have to be so expensive … or transformative!

We completely agree! At Aptitude Software, we believe that finance can become more strategic while addressing immediate requirements.

Our customers have a range of needs such as consolidating monthly trial balances (MTB), putting workflow around manual adjustments processes, or applying a new accounting policy.

Most of our customers would not consider undergoing “finance transformation” to address these requirements. This is in large part because such ‘transformations’ are associated with big multi-million dollar, multi-year IT projects or ERP upgrades – a pill that no one wants to swallow!

A progressive approach to finance transformation

Fortunately, there are approaches that enable finance to address tactical requirements while progressively improving one’s finance architecture.

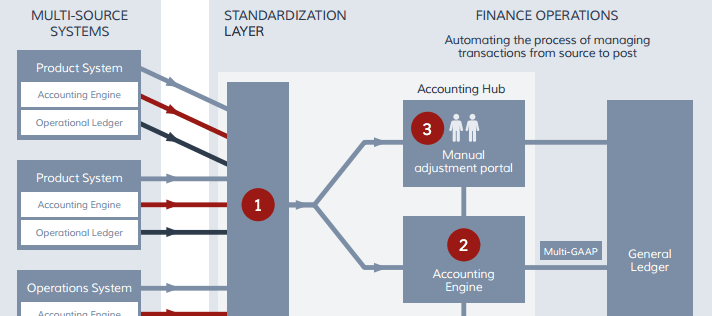

Two components that can help finance pursue continuous improvement amidst the onslaught of new requirements are a ‘data standardization layer’ and an accounting engine. The former enables CFOs to standardize how finance integrates, validates and enriches data – whether it be transactions, balances or debit/credits. An accounting engine represents ensuring finance (not IT) have direct control of accounting rules.

Importantly, these components leave a platform to more quickly address new requirements, integrate new businesses and build a financial data foundation that will enable CFOs to truly transform finance.

//

Check out Aptitude Software’s brochure on finance transformation. We’re always keen to discuss new finance requirements with new finance or finance IT leaders. Get in touch with us at marketing@aptitudesoftware.com