Aptitude Software president Tom Crawford and SVP of Product and Delivery Martin Redington led a discussion about IFRS 15 and what European operators can learn from their peers in the US and Asia.

For a link to the webinar recording and slides, please contact patrick.youngs@aptitudesoftware.com.

It is clear that global operators are catching up with the requirements of the IFRS 15 revenue recognition standard and are preparing to implement solutions in time for the 2018 deadline.

The webinar included a discussion of the many challenges and scenarios that operators face. Here are some key takeaways.

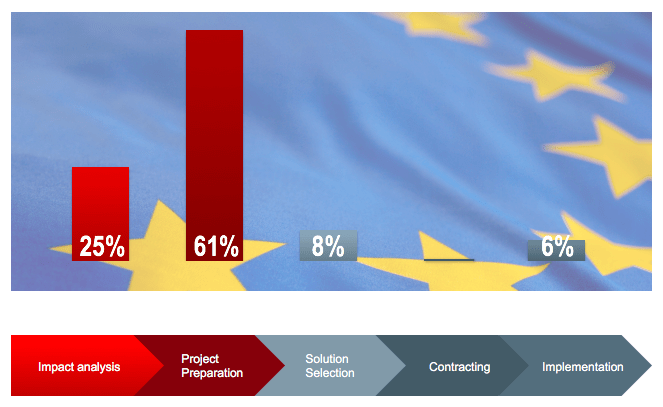

1. Despite the closing deadline, most companies are still preparing their project teams

It’s clear that while a few companies are progressing with choosing, contracting and implementing a solution, most are still deciding how to go about their projects.

At this point many companies are defining their strategy for tackling the technical challenge as well as testing specific, challenging accounting scenarios. One key aspect of this is choosing between a portfolio and contract approach.

2. Consensus across the US and Europe is leaning towards a contract approach

There are benefits to both choices, with portfolio making calculation volumes considerably lower and contract providing much clearer auditability and the ability to unlock value beyond compliance.

The key factor which has swayed US and Asian telcos as well as a number of Europeans is the complexity of accounting calculations when contracts within portfolios or portfolios themselves are modified. Aptitude Software can cater to either approach but we find the contract approach more beneficial. By applying appropriate processing power, the contract approach is stable in the face of change and creates a financial foundation for much broader financial reporting and analysis.

3. A finance transformation can deliver much more than simply compliance

Complex financial processes and architectures hinder the amount of valuable information that can be produced by Finance. By structuring a revenue recognition solution to allow granular, contract-level reporting, you can streamline finance to use accurate, trustworthy data across the board.

4. Granular contract data can provide a step change in reporting capabilities

If clean, finance-accurate data moves under the control of Finance, it can provide a more transparent link between costs, cash and revenue. Opportunities can then arise for further analysis into customer lifetime value, product profitability reporting, ARPA, revenue forecasting and much more. We are already seeing customers start on a compliance project and decide that broadening the scope for better reporting and analysis provides a much greater ROI for the project as a whole.

If you would like access to the webinar recording with questions and slides, please let me know via email at patrick.youngs@aptitudesoftware.com.

To find out more about Aptitude Software’s Revenue Recognition Engine, visit our solution pages here.