In our final blog in this series assessing the impact of COVID-19 of the media subscription industry, we tackle the question, “What will happen to subscriber growth rates after COVID-19 lockdown restrictions are lifted?”. We also show how MPP Global can help to significantly reduce the risk of revenue loss from churning customers with the most advanced data driven retention technology specifically built for the media industry.

Spoiler alert – the short answer is – nobody knows. Whilst the world has seen recessions in the past, the digital publishing and entertainment industries are, by comparison, very new. The last model that even comes close is the 2007-2009 recession, where some global economic variables didn’t recover until as late as 2014. Indeed, even giants like Netflix have no real model for subscriber numbers when looking to the future, having added 16 million subscribers in the first half of 2020.

In the absence of any specific data on what could happen, most organizations are resorting to both tried-and-tested and emerging churn prevention practices. Media organizations who can successfully identify new subscribers likely to churn from their service, and proactively engage them before they actively terminate their subscription will be the winners.

There are several business models to consider. As a broad example, in Spain, there have been easings of restrictions on specific industries which in turn has meant certain demographics looking to return to some form of normal. If you are a media enterprise in Spain, and these industries contain your core consumer base, this is the ideal time to focus on retention offers for those customers.

Equally, in the US, some states are looking to lift restrictions as soon as possible. Customers in those regions will be more reliant on up-to-date information on the spread of COVID-19 and therefore these subscribers may be more receptive to retention tactics from news publishers and broadcasters as a result.

How MPP Global Can Help Retain Your Subscribers

The specific strategies are still difficult to predict, but the processes and tools are likely to be largely the same: preventing churn through contact with the customer, providing enticing offers and react accordingly to the likelihood of cancellation.

Predictive Churn

The first step is to attempt to prevent churn in the first place, and this can be accurately tracked using Aptitude’s subscription churn prediction functionality. Our analytics dashboards and reporting suite include churn prediction reports, which will highlight various factors that infer when a customer is likely to churn, as well as providing a final assessment score. Your Customer Support and Retention teams can then use this information to proactively engage the customer and take any steps necessary to retain the customer before they churn, such as a retention email campaign with discount voucher codes.

Clíona Mooney, Head of Subscriptions and Reader Insights, The Irish Times

Leveraging Machine Learning algorithms, media companies can accurately identify up to 90% of customers who will churn next month. This provides powerful insights from your subscriber data by arming you with a monthly report of the customers who are about to churn, enabling you to act decisively.

Learn more about how Irish Times use Subscription Management to prevent churn.

Turn the Churn

Like all services, there are customers that will inevitably churn on their own accord. Reasons a customer might churn include: lack of interest or need of the service, can no longer afford the service, only wanted a free trial of the service and beyond.

Gathering that information as part of the cancellation process enables the service to tailor a win-back flow to entice customers back to the service. For example, if a customer has expressed that they can no longer afford the service, then triggering a voucher code for 50% discount for 3 months gives the service more time to work on retaining that customer long-term with personalization. 50% of that customer’s payments, with 3 months to re-entice the customer, is much better than 0% and a lost customer.

There are several tactics, using toolkits such as Subscription Management and its partners, which can be adopted to prevent voluntary churn. Examples include:

- Targeted offers & promotions such as discounts, free months, additional entitlements etc.

- Offering the ability to pause subscriptions payments & entitlements

- More personalized content recommendations based on previous viewing habits

- Upgrade/downgrade/switch subscriptions to provide a more tailored service to the customers’ needs

Involuntary Churn

Where you do succeed in retaining customers, it is important not to lose them further down the line. There are many preventable payment breakages which cause involuntary customer churn such as: card expiring, insufficient funds in customer account and lack of optimizations for recurring billing. Subscription Management’s payment optimization functionality can seriously benefit your bottom line by reducing churn by 10% or more for some enterprises, which can mean thousands, if not millions in retained revenue.

Card Updater Services

Subscription Management’s Card Updater service helps to minimize loss of business due to customers’ payment cards becoming outdated either by expiry or marked as lost/stolen, helping to improve the customer experience, and ultimately, reducing churn revenues significantly.

Subscription Management is integrated into both the VISA Account Updater (VAU) and the MasterCard Automatic Billing Updater. Using these schemes, Subscription Management can obtain new customer payment details when they have been changed without the need for the customer to update any information themselves, thus allowing recurring payments to continue seamlessly as a result, maximizing revenue and reducing churn where it would have otherwise been unavoidable without contacting said customer.

Card Updater can be used in conjunction with Retry Rules (below): so, after a predefined number of payment failures, the update process is initiated.

James De Wesselow, Head of Subscriptions, Racing Post

Retry Rules

Subscription Management’s Retry Rules enable media companies to define specific events that trigger the process for retrying card payments, should they initially fail. Such service safeguards revenues and drastically increases the likelihood of retaining the customer.

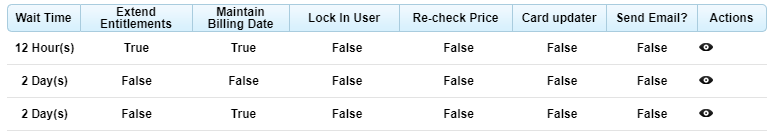

Retry Rules are defined by the client as rule sets. Each rule set consists of a sequence of one or more rules: The specification for each rule, per subscription, includes a ‘Wait Time’, which is the amount of time that should elapse following the latest payment failure, before the next payment retry is executed. For example, you may wish to attempt payment 24 hours later, and then perhaps try again 1 week later.

Retry Rules in Action: In June 2018, Visa reported a service disruption that prevented the processing of millions of Visa debit and credit card transactions in Europe. During the disruption, many customers were unable to use those cards directly to make purchases, while shops and merchants were unable to process both one-off and recurring payments. Despite this, +91% of the payments impacted were successfully collected and processed thanks to the functionality available through the retry rules and grace periods. You can read more about this and how this benefited clients such as The Irish Times, here.

Payment Suppression Windows

Card payment failure is often associated with specific days of the week, and hours of the day. For example, banks’ fraud protection rules tend to be stricter during the early morning hours, when legitimate card owners are assumed likely to be asleep. Additionally, banks’ infrastructure-maintenance schedules (designed across the industry to take advantage of the same, relatively quiet periods) may also result in payment failures.

An Enhanced Payment Window is the ability to specify, per country, optimal times a recurring payment transaction for a subscription is to be presented for payment processing.

It’s a simple way to cut down on the number of failed payments and this type of consultancy forms a part of the relationship between MPP Global and its clients, who share the same goals.

MPP Global announces Predictive Churn capability

Conclusion

Across this series of blogs, we have looked at the initial impact of COVID-19, some statistics on how it has affected our clients, and we have asked our own clients for their own perspectives on these unprecedented times in our industry. At the time of writing, the lockdown is still in place with no definitive timescales of when things may change. As a result, publishers and OTT providers remain focused on acquisition and retention. We are committed to continuing to provide insights based on our privileged position in the market and have already expanded on the concepts of this blog in the guide below.

[DOWNLOAD] A Guide to Optimising Recurring Card Payments & Minimising Churn

To find out more about our payment optimization & retention capability, download our 5-step guide to learn more about how this toolkit could benefit your revenues.

Have you got a post-COVID-19 plan yet? We can advise and consult with tactics and tools to reduce churn & maximize revenue. Book a demo below with one of our payment industry experts.

We’re here to help

If you are reviewing your subscription strategy, get in touch to arrange a demo of how we can unlock all the tools needed to succeed now, and in the future.

Contact our helpful team; Telephone +44 844 873 1418 or visit our contact us page.