COVID-19 lockdowns saw subscriptions revenues surge amid an overnight explosion in digital media consumption. With pent-up demand at fever pitch as live sport returned, similar opportunities are anticipated for sports OTT services. This blog covers the lessons learned from digital media and how sports can embrace the same tactics to drive fan acquisition and minimize churn.

Key Takeaways

- Provide attractive discounts, but not too attractive that you miss revenue opportunities and increase short-term churn.

- Longer-term subscriptions increase lifetime value.

- Use technology to predict voluntary churn and kill involuntary churn.

- Finally, and most importantly, serial Content Is King. Providing content which becomes habitual with your customer-base, outside of live sports, creates a strong and loyal customer base.

Introduction

In the middle of March 2020 something very strange happened to us all, and Coronavirus necessitated the world to be locked down, almost instantaneously. With the lockdowns we saw an overnight explosion in media consumption, and at the same time, all live sports were suspended. The consequences for the media and sports industries couldn’t have been more different or profound.

Working in these sectors gave MPP Global a unique vantage point from which we could draw insights and share experiences from the media sector. As live sports were restarted in June, the sports sector found itself in the same situation that media saw, 3 months earlier.

This blog shares with you the lessons learned from the media sector and how sport can embrace the same tactics to drive subscriptions and minimize churn.

“Coronabump”

Mainstream OTT, News & Media have benefited greatly from global lockdowns. And those with recurring subscription revenues have benefited the most since they have seen huge spikes in subscriber numbers. For example, Disney+, whose UK launch date coincided almost exactly with the lockdowns, will have 4.3 million new subscriptions by the end of June.

An incredible 4m subscriptions from a standing start in a few short weeks!

This puts the service behind the more established Netflix and Amazon Prime Video, but already ahead of Sky’s Now TV, and ITV and BBC’s BritBox. Whilst the numbers are staggering, we should not be too surprised. People were being furloughed, schools were closed and none of us could do any of the normal things we love to do.

And so, people kept themselves engaged by doing more of the things they can do at home, and this included going online more and watching videos more. A whole lot more!

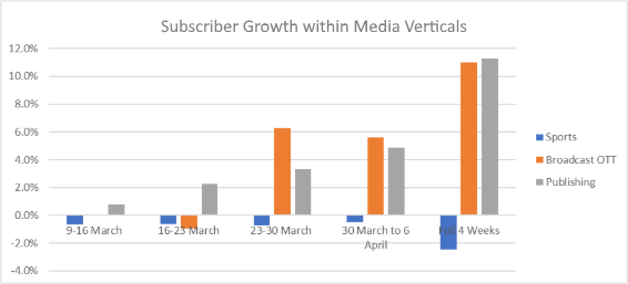

While Media took off, Sports tanked. We can see that from the stats when we analysed our own data and, in the weeks, following the coronavirus lockdown media companies made hay whilst the sun was shining. Colloquially known as the ‘Coronabump’, media companies accelerated their subscriber bases with massive gains. Netflix, Amazon Prime, Disney+ and NOW TV all reported a surge in new subscribers.

The picture was not so rosy for companies in the sports sector. Across MPP Global’s own sports clients, subscriptions started to wane more rapidly after about 4 weeks, as monthly subscriptions began to expire. Of course, without any live sports to watch on TV or online, this is hardly surprising.

Sports is having a tough time, losing a projected $60bn in revenues by the end of the year. But Sport is re-starting and now is the time to capitalize. SPORT IS BACK!

Sports Return….

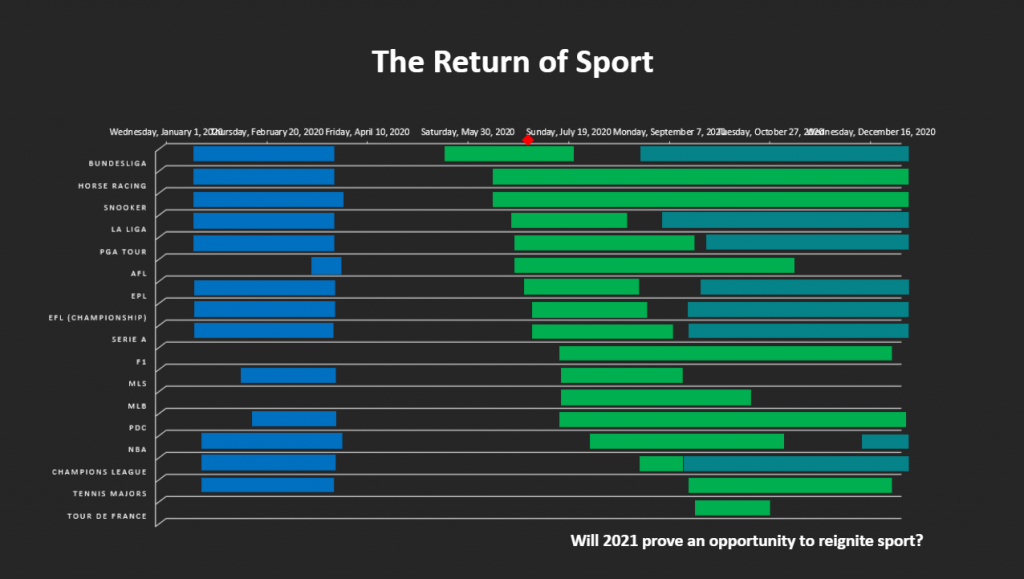

You can see from the graphic that sport is returning in a big way over the next few weeks. All the major sports are returning, which is set to delight fans around the world. Many of the canceled events this year, like the Olympics, Euro 2020 and Copa America will fill our calendars next year. This year’s events, like the French Open, will be in September instead of May, and the Tour de France will start in August, two months later than normal. The Ryder Cup remains undecided.

What is clear is that all the major events we have so badly missed over the last 3 months will play catch-up and provide sports fans with a veritable feast of live sports content over the next 12 months!

And, with that, opportunities beckon.

For example, the return of the English Premier League and Manchester City’s 3-0 victory over Arsenal was the most-watched Premier League match in more than three years with a peak audience of 3.4 million viewers. It also became the most-viewed ever match on Sky Sports not featuring Manchester United or Liverpool.

The BBC, showing their first live league game for over 30 years, attracted 3.9m viewers for the match between Bournemouth and Crystal Palace. Within a week, Sky had broken more records, this time attracting 5.5m viewers for the match between Liverpool and Everton.

But let us consider the big hole in the middle of the sports calendar when there were no live sports anywhere. There can be no doubt that media companies helped fill the void, and sports fans turned to news and entertainment sources to fill their entertainment vacuum and find new places to spend their finite budgets. Sport is back now.

But what is sports going to do to win back discretionary spend? And how can we apply the lessons learned not only now, but also in future years when single sport services have their off-season?

Lessons Learned

Let’s look at the strategies of media companies during the last three months and how they accelerated and capitalized on a captive “locked-down” market, and how sports can adopt similar strategies as live sport returns to our screens.

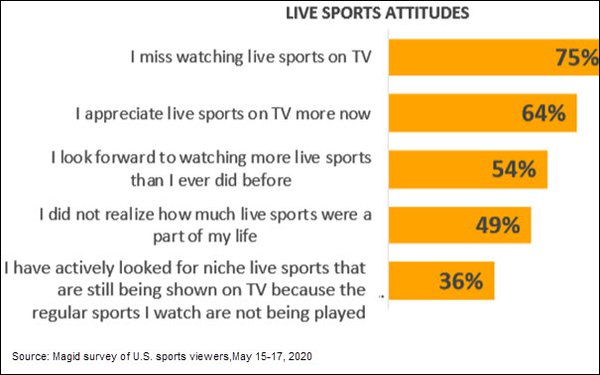

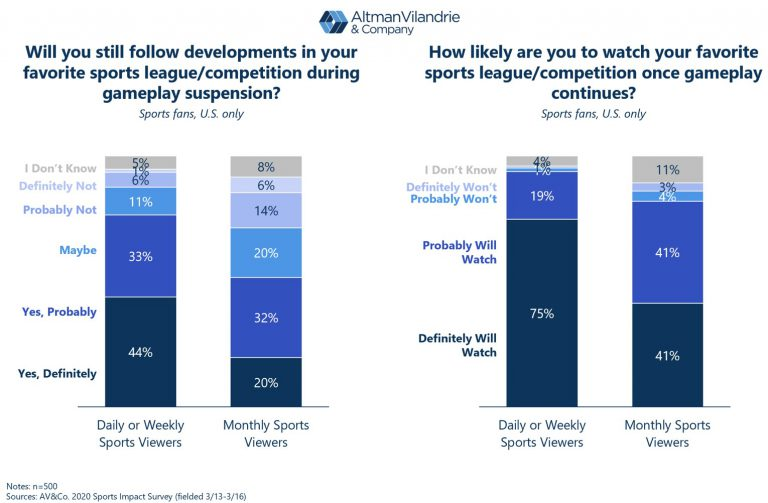

Attitudes in Live Sports (Source: https://www.mediapost.com/publications/article/352230/magid-live-sports-return-will-reverse-spikes-in.html)

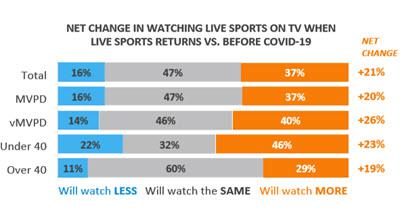

Changes in Watching Sports Live (Source: https://www.mediapost.com/publications/article/352230/magid-live-sports-return-will-reverse-spikes-in.html)

Campaigns & Content

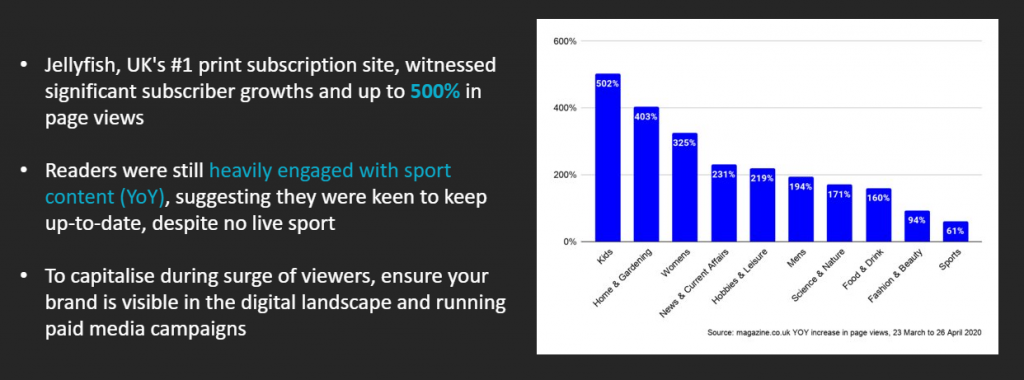

As lockdowns kept people at home, the opportunity for Media companies to attract new subscribers was at its highest. So, how do we capitalize on this captive market? Our partners at Jellyfish, who operate the UK’s leading magazine subscription service, witnessed huge spikes in subscribers, particularly in printed magazines, which have doubled digital. Kids’ titles increased a whopping 500%, with Home & Gardening up 400% and Women’s titles up over 300%.

The advice from Jellyfish is simple; to scale and capitalize during the growth times you still need to make your brand visible in the digital landscape and running paid media campaigns is key.

- In their campaigns, publishers called out offers, such as free delivery

- They told us we could have “Free access to digital editions” and promoted their other USPs

- Publishers realized more people search on their mobiles and so campaigns were mobile-friendly or mobile-first

- They worked hard to make sure campaigns were at times of the day when search and sign-ups were at their highest

- Publishers didn’t forget about social!

- And they made sure they had a killer and slick landing page to ensure conversion

Whilst campaigning and brand awareness is crucial, so too is offering a range of payment types; the types which offer least friction. PayPal and in-app purchasing are good examples of this. Modern-day devices are more sophisticated and securely store credit card details which Can auto-populate payment forms, making purchasing much easier for customers.

Content, content, content! Content is key and without compulsive and must-have content, even the best campaigns will stutter and churn rates will be high. Content is central to promotional campaigns and, even better, so too is word of mouth, to help drive subscription volumes.

- Frozen 2 was made available on Disney+ three months ahead of schedule and along with the hit TV series The Mandalorian, helped Disney accelerate subscription numbers so quickly.

- The highly acclaimed Michael Jordan documentary “The Last Dance” wasn’t supposed to launch until the NBA finals in June, but was instead released 2 months earlier. This helped Netflix add 16m new subscribers in Q1, more than double that of Q4 last year.

The key take-away for sports is that having great, exclusive or niche content is the most important factor, but to truly capitalize on Sport’s return is to shout from the rooftops and ensure all your prospective subscribers know it too.

Offers, Discounts & Trials

With great content and wide-spread promotion driving people to your website in their droves, and a slick landing page to convert visitors into subscribers, now is the time to get people over the line and paying for a subscription with a great offer – but only if you have to. Great content doesn’t always need a big discount to get people subscribing. And discounts which are too big or too enticing will often lead to much higher churn rates. The challenge is getting the balance just right.

As we know, everyone likes a discount or ‘something for nothing’. With free trials and low start offers, or limited time offers in conjunction with a discount code, we can get creative on how we convert people into paying customers.

Sky Sports and BT Sports slashed their prices ahead of the English premier league restarting. Fans will now be able to get a NOW TV Sky Sports Month Pass for £20 a month instead of paying £40, while BT Sport reduced their Big Sport package by an identical amount!

Media companies offered upsell opportunities to increase ARPU with their existing subscriber base. Not only does this increase revenues, but it helps to reinforce loyalty and value of money. For example, Sky recognized that more people would be at home and wanting to better share a family subscription. So Sky offered a service called “Boost” which provides OTT in full 1080 pixel HD, dolby surround sound, the ability to watch on 3 devices at the same time and having up to 6 devices registered to a single account.

Virgin Media didn’t upsell to their mobile customers, they simply gave them a boost of 10GB extra per month, and a ton of additional TV channels for no additional charge. Visits to NHS websites did not reduce data allowances from bundles. Virgin also upgraded their broadband customers from superfast to ultrafast for free.

Freemium and free-to-air models were very popular. Newspapers relaxed paywalls so that COVID-19 related content always remained free . SLING TV in the US created a registration-wall which made all their video free-to-air after you had registered for an account. The NBA, PGA and MLB opened free access to their content archives.

The key take-away for Sports is to balance the strength of sports content and the breadth of marketing campaigns with the attractiveness of the offer or trial. Competition may force your hand, but whilst discounting too much will lead to upside in the short-term, it will likely lead to increased churn over the longer term.

Pricing

A humanitarian crisis is not the time to increase prices. The rest is open to creativity and marketing prowess. Pricing is allied with promotional activities and, when attracting new subscribers, cannot be separated. Many publishers offered large discounts or removed subscription fees and unlocked their paywall. OTT and pay-TV companies paused payments altogether in some cases.

Bloomberg, for example, used discounted pricing to offer a two-year subscription to their customers. And why wouldn’t they? Long-term subscribers are far more valuable than monthly subscribers.

But it came with a warning: as Bloomberg’s Global Head of Subscriptions and Consumer Marketing, said, “The lower you go with your pricing, the higher your churn is going to be and so striking that balance is really important.”

Alongside the 2-year subscription, Bloomberg also offered monthly and annual subscriptions. This was smart, as Bloomberg were applying the “rule of three” which psychologically attracts people to the middle offer; which in this case was the annual subscription.

NZME, owners of the New Zealand Herald, experienced a surge in online subscriptions in the past four months, racking up more than 70,000 paying subscribers. 25% are on annual subscriptions. The Irish Times offers a Free Echo Dot and the New York Times offers attractive discounts to 12-month subscriptions.

Der Standard, the Austrian newspaper, introduced an innovative ‘contributions model’ as the pandemic picked up pace. They did this by offering free access to high quality news, and asking for a donation if their customers appreciated the level of journalism and lack of fake news! At present, they’re experiencing a revenue split of around 25% from donations and 75% from recurring subscriptions. They have already met their donations target, something they had not expected to do until the end of 2020.

So, what can Sports learn? If you price too low you could be missing out on revenues during a boom, and increase the risk of too much churn later. Pitching a long-term subscription with a modest discount improves lifetime value.

Retention & Churn

We have discussed pricing being allied to promotions and also linked with churn.

Long-term subscriptions consider what will happen as people get back to their normal lives and churn levels increase. Having subscribers locked-in for one or even two years is a great way to improve your churn numbers!

Niche content and Sports content are the worst for chronic churners, according to Boston Consulting Group, with up to 30% of the subscriber base canceling and re-subscribing two or more times in the previous two years, compared to less than 10% for Core content providers (such as Amazon Prime and Netflix).

This goes someway to underline the desire to maximize conversion rates to long-term subscriptions. At the same time, if we accept that sports content naturally attracts customers on a transient, seasonal or per live event basis, offering day passes or event passes becomes a viable option. This has proven popular with NOW TV in the UK.

For example, one Sunday a few years ago, you were able to watch Master’s golf, Ashes test match cricket, a Formula 1 race and Manchester United vs Manchester City on a single day pass which was excellent value for money! Convenience is key for regular purchases of day passes, making it easy for your customer to sign-in and one-click purchase a day pass to provide seamless access to great sporting action.

But you cannot stop there. As life gets back to normal, we have to work hard to keep subscribers and avoid the ‘churn and burn’ factor, which is a real fear in the Publishing sector. Clever ‘off-boarding’ cancellation journeys can be introduced to try and steer customers away from cancellations, with exit surveys that guide subscribers to a more suitable package, the ability to pause, or even provide a unique offer based on their consumption patterns.

That means continuing to provide great live sports, but that might not be enough to avoid churn and providing subscribers with more than they expect will be important. This can include exclusive interviews, a broad archive, podcasts, exclusive content, watch-alongs, eSports and more.

You can also use algorithms to predict churn and use past consumption behavior to promote upcoming content which will appeal to consumers. Or if you can see someone has been a light user in a month, surprise them by putting credit on their account which can be deducted in future months.

Let’s not forget about involuntary churn. It is amazing how many subscribers are lost because a payment cannot be collected. MPP Global work with a large OTT client who was experiencing 10% monthly churn due to payment declines. To combat this we implemented suppression windows, multiple payment retries and card updater services, which is when you request new card details from the card schemes when a card has expired or has been stolen and replaced. This resulted in reducing involuntary churn from 10% to under 1%.

To reiterate – great content leads to loyal customers. If you can, create as much habitual content as you can to compliment your live sports events, and you will see fewer cancellations.

We’re here to help

If you are reviewing your subscription revenue strategy, get in touch to arrange a demo of how we can unlock all the tools needed to succeed now, and in the future.

Contact our helpful team; Telephone +44 844 873 1418 or visit our contact us page.