65% of Media Companies Express Challenges With Involuntary Churn

65% of Media Companies Express Challenges With Involuntary Churn.

In a recent webinar hosted by MPP Global, on the topic of subscriber churn, a survey was conducted with over 100 global media companies to understand their challenges with involuntary churn. Chris Welsh (SVP, Broadcast & OTT) and Paul Roberts (Payments Product Owner) at MPP Global offered insight on both voluntary and involuntary churn and provided practical strategies to improve churn metrics.

Analyzing both industry benchmarks and data held by MPP Global, the webinar underlined why churn is an area of focus for many media companies. Research by Parks Associates (2019) showed that some SVOD services were seeing churn rates of up to 35%. More recently, in the publishing industry, WAN-IFRA (2020) noted several newspapers were displaying churn rates post-lockdown, of up to 50%. Additional factors to churn included regional variations which highlighted APAC being lowest, and NORAM highest for churn, as well as the length of time a customer has been subscribed, with the first 60-90 days (typically the trial period) proving highest for churn, before dropping by up to 68% after this period.

With the average ratio between voluntary and involuntary churn being 3:1; 20-40% of churn is needless and preventable. MPP Global’s survey sought to uncover some of the key reasons why media companies battle with involuntary churn.

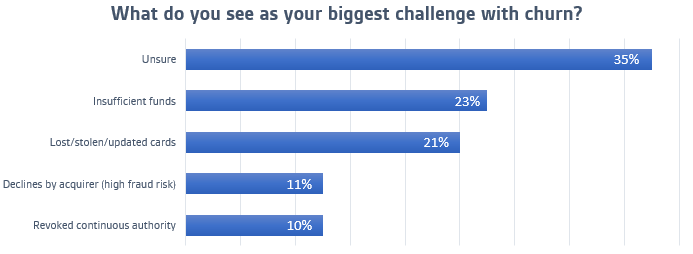

The results showed that 35% of the media companies surveyed expressed that they lacked resources and visibility to understand the causes of involuntary churn, highlighting the complexity of customer retention and how each organization faces their own challenges.

Additionally, customer insufficient funds were noted as a problem area for many companies, with 23% of attendees indicating that failed payments are a major issue, pointing to a lack of payment retry functionality to re-attempt renewal payments at an alternative day or time.

The survey also revealed that many media companies struggle with lost, stolen, or expired cards, most commonly due to the lack of card updater functionality working with Visa’s & MasterCard’s account updater services. With over 30% of active customer cards requiring updated details per year, this issue is likely to cause considerable loss in revenue over time.

Finally, a smaller percentage of respondents noted issues with declines throughout the payment ecosystem, particularly with acquirers deeming some transactions to be high fraud risk. Reducing declines is a key focus of the webinar.

This research offers a glimpse to media organizations that when it comes to churn, there isn’t a one-size-fits-all approach to improving churn rates. Rather than benchmarking externally, benchmarking internally may be more fruitful, investing in the technology and expertise to define the specific causes, and roll out incremental measures to optimize.

Watch the full webinar to gain valuable insight into how to proactively prevent churn through Subscription Management’s powerful Retention & Recovery module, how to identify types of churn, and how to reduce revenue loss through involuntary churn.