Introduction

Customer Lifetime Value is an important commercial metric. It indicates, in simple terms, the value the customer over the course of their subscriber lifetime. 60% of publishers in the US actively track this value. However, CLTV doesn’t show how long that period is – this is down to the retention methods and the perception of long-term value in the service itself.

The longevity of a subscriber is dictated almost entirely by how they perceive value in the service. They will cancel their subscription and churn if this expectation isn’t met. Thankfully, there are lots of actions you can take. Building a diverse product portfolio, informed pricing, and promoting engagement to encourage loyalty. All these strategies need one magic ingredient – insight. And the only way to get this insight is to understand your subscribers.

This blog outlines ten of the best pricing strategies that help with customer revenue growth.

Freemium

Free Trials are still popular, but it’s important to show that your content has value to it. An effective model to grow this sense of value is the ‘freemium’ model. Subscribers can gain access to specific content, in return for their registration details. Their viewing habits and preferences are then tracked by cookies as they consume content.

This data is then used to serve the subscriber with intelligent, personalized content packages, or highlight areas of the ‘all you can eat package’ to encourage upsell. Freemium conversion rates, on average, sit somewhere between 2% to 5%.

French sports paper L’Equipe’s Freemium model (Source:L’Equipe)

Bundle / Unbundle Pricing

Putting all your content in an all-you-can-eat package, is a common strategy for a subscription product. There’s a clear value to the customer in being able to subscribe to everything on offer. Topic-specific services (for example, fishing, motoring, or camping) typically use this model. Their subscriber base is usually engaged with their whole content offering.

For more diverse portfolios, consider unbundling. Providing topic-centric packages will suit ‘fly-by-trial’ subscribers with a relatively low CLTV and conversion rates. The ‘neglected middle’ subscribers, those who subscribe to full packages but concentrate their interest in key topics and engage less with the rest of the content catalog, will benefit the most.

To increase CLTV and serve both markets, consider offering tailored packages for the subscribers that show less engagement while keeping strong value in the full package for the rest of your audience. Balance is key. The package must be better value than individual packages, while still having a lower barrier of entry in terms of cost. That way, your ‘all you can eat’ subscribers still feel they’re getting a good deal, while providing value to your remaining audience.

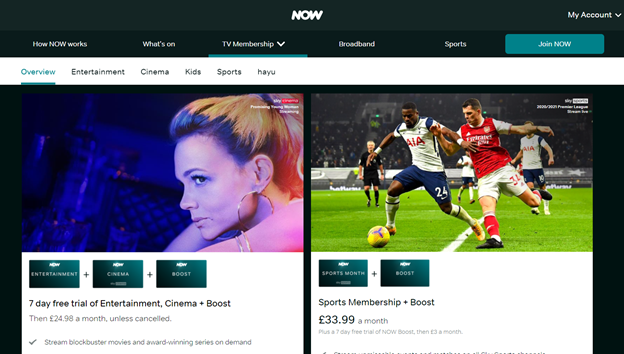

NOW (formerly NOW TV) have established this model in their Cinema, Entertainment, Sports and Kids packages, while also offering package deals on Cinema and Entertainment. NOW sets the benchmark in subscription flexibility in the SVOD industry.

Many major news publishers such as the Times, The Guardian, McClatchy, and others, use a similar model. the ‘best value’ is found in a print and digital subscription, but subscribers can find a subscription that is right for them from a range of options.

NOW’s bundles, either together or available unbundled (source: NOW)

Stepped Pricing

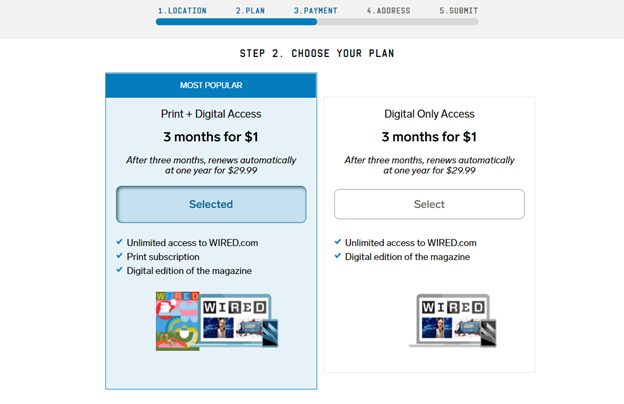

A traditional trial takes the form of a free period, followed by a full-paid period. Triallists can cancel before payment is made. The problem here is that a free trial does not reflect the value of the content you’re producing. An alternative is stepped pricing, which puts a smaller, ‘trial’ price at the start of the subscription. The most common form of stepped pricing is a lower price trial period, for example, £1/$1/€1 for one month, before stepping up to full price.

The model can go even further, introducing steps, and even adding exclusive features as the price increases.

This model demonstrates value right at the start of the subscription, and even low lifetime value subscribers and ‘fly by trial’ subscribers still generate revenue. It’s also great for the subscriber as they get a better deal on their subscription.

Wired Magazine combines stepped pricing in their trial, and bundle pricing (source: Wired)

Tiered Pricing

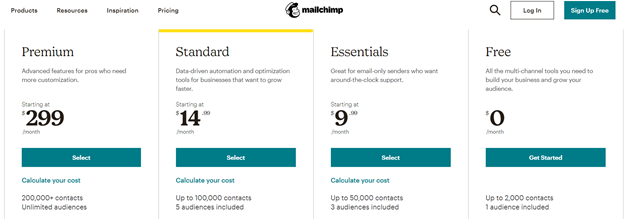

Tiered pricing is like Stepped Pricing, only the onus of switching up is on the subscriber. The customer can gain access to more content by opting to ‘upgrade’ their subscriptions. The SaaS industry is the main proponent of tiered pricing, where prices are separated into Plans, but this model can also work for content services with wide portfolios.

The most common format is a single product with a low monthly fee. Incentives to subscribe to more comprehensive access are available at higher price points. There is research to suggest that companies operating five tiers or more realize 40-50% higher ARPU than those with fewer than five (including none) though there is a balance to be struck as too much choice can also be a turn subscribers off.

MailChimp’s plans echo most of the SaaS industry, but SVOD and Publishing offerings could be split in the same way (Source: MailChimp)

Differential Pricing

The most common example of differential pricing, also known as discriminatory pricing, is price based on decisions about the customer. This includes location, device, group, customer type, demographics, regional GDP etc., but could be applied to any parameter.

Loyalty cards or subscriber prices are a great strategy. Offering subscribers discounts as a reward for maintaining their accounts, alongside exclusive offers, results in improved retention and therefore improved revenue growth.

This is common across OTT and Publishing sectors but is most beneficial for services with a global reach (and in the digital age, there’s very little reason not to be global!).

It’s possible to build a pricing matrix based on all kinds of demographics or key information, but a word of caution – potential subscribers value transparency. Obscuring a pricing matrix or using a matrix behind the scenes to benefit some customer groups over others, could have a negative impact on your service’s image.

Role Based Pricing and Family/Business Plans

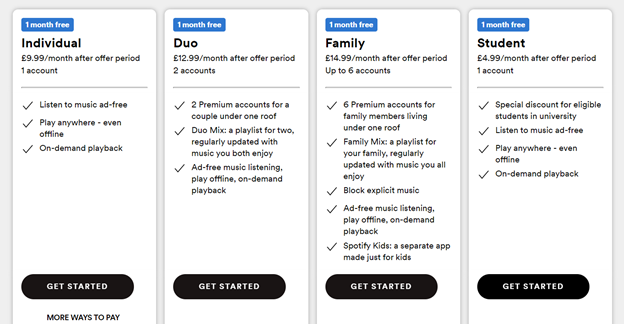

Role based pricing is like differential pricing in that it provides a price based on certain attributes. Common examples include student, Over 65’s, Family plans or Business accounts. The advantage is that subscribers will perceive their ‘demographic’ price to be a better deal than a standard subscription.

This practice is far more common in publishing than in OTT. Music service Spotify and Amazon’s offering are both well known for their generous family and student discounts. Spotify have free, individual, Duo (2 devices/accounts) and Family (5 devices/accounts) subscriptions available.

Corporate accounts are popular in the publishing industry, which allow business subscriptions under many accounts. The parent organization pays for the subscription on behalf of its employees. A great perk for the team!

Spotify’s range of premium plans (Source: Spotify)

Super-Premium Pricing

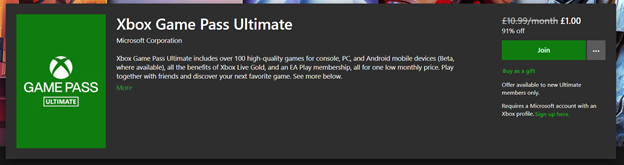

Why not have one, all-encompassing ‘super-premium’ offering; a top-tier, platinum package? There are two key advantages with super-premium pricing.

Engaged, loyal subscribers have an opportunity to invest fully in the service, as a ‘badge of honor’ of being part of the community. This increases CLTV and is also great from a community ‘brand ambassador’ perspective. There’s huge value in positive word of mouth as a driver in acquisition as well as retention and revenue growth.

Secondly, adding a top-tier price sets the maximum that subscribers could pay for a service. This sets a ‘price anchor’ in the minds of subscribers and potential subscribers. Any price below this will be seen as a deal in some respect, which in turn makes standard subscriptions seem more affordable. This, in turn, boosts conversion rates.

Microsoft’s Xbox Ultimate Pass contains all of the available Xbox console services, including their partnership with videogame publisher EA. (Source: Microsoft)

Urgency Pricing

It’s a tried and tested strategy – Fear of Missing Out. Time-limited deals is the most common method, where a discounted price is available for a set period before ‘it’s gone’.

OTT providers like Disney+ have started to see the benefits of using this approach. This sets an extra dynamic in the minds of the consumer; wait until the end of the deal period and the number of passes or items may have sold out.

This works best on one-off content, as the subscriber can enjoy exclusive content that may not be available anywhere else. Virtual tickets (such as live-streamed conventions or events), live sports, or content where the subscriber can get involved are great examples.

Releasing waves of limited passes also generates buzz around content and drive engagement. The price increases incrementally in each ‘wave’, pushing the FOMO factor further.

Dynamic Pricing

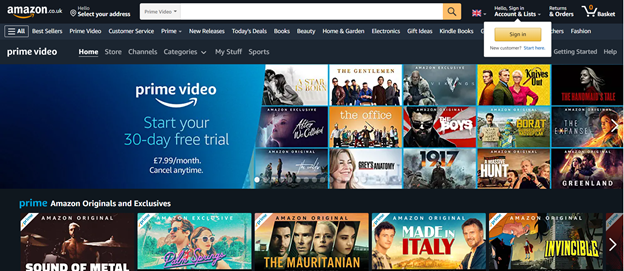

Dynamic Pricing, or Propensity Pricing, is the next step of any pricing strategy. It relies on rich consumer data, persona building, and the ability to deliver personalized content and pricing offers at scale. It’s a tall order, but with a flexible subscriber management solution, aggregated data, and A/B testing, true next-generation customer experiences will drive up acquisition rates. Currently, just 17% of US publishers personalize their communications with subscribers based on their reading habits.

A process that analyses a subscriber’s viewing habits and then suggesting a subscription package tailored to them improves subscription rates. From a revenue optimization perspective, that same system should track engagement rates. This data is then used to make suggestions to the subscribers with the highest chance of conversion and retention.

As an example, a subscriber who has watched their favorite show gets new suggestions of similar programming in the credits. Most of the Big Three SVOD services (Netflix, Amazon Prime and Hulu) already have this functionality. Similarly, a subscriber who has been engaging from a specific device, such as their phone, can be served digital-specific subscription offers.

Dynamic, personalized experiences driven by data are the future of the digital subscription. This should be the goal of any subscription service.

Amazon Video is just one SVOD service that tailors content offerings and recommendations to the subscriber (Source: Amazon)

Incremental Price Increases

In 2021, Netflix increased their price point on their Standard and Premium packages in the UK from £8.99 to £9.99 and £11.99 to £13.99, respectively. They maintained the Basic package price of £5.99 as the lowest point of entry. This is a good example of Incremental price increase, where the price of a service increases at set points. The basic package remained competitive for the users that may have otherwise churned due to a subscription increase. The subscribers that were more engaged and loyal (and so higher CLTV) found the price increase negligible.

This results in a 1% increase for the subscriber, but a significant increase in revenue for Netflix. Revenue that will go towards more content, and a better service, was the communication strategy to subscribers.

It’s an excellent lesson; the reason behind the price increase is communicated clearly, and higher-tier customers were given an option to downgrade, rather than cancel outright and churn. Give your subscribers information and options, keep their loyalty, and they will reward you.

Netflix clearly communicated their reasons for the price increase and gave subscribers a range of options. (Source: Netflix)

Conclusion

CLTV is important commercially but is not fit for use as an engagement measurement tool. To understand subscriber value over time, study their engagement compared to the price they are paying. How do they perceive the value of your product? Content? Great subscription options? Customer engagement?

All these strategies and even combinations of pricing strategies are available in Subscription Management. Subscriber data can be centralized or connected from third-party data solutions. It’s possible to test different pricing models and find the right balance for your organization. Subscription Management’s advanced data modeling solution also opens the ability to build intelligent pricing.

Integrate Subscription Management with your existing tools to completely understand your customers. Use your data intelligently to tailor your subscription offering. With Subscription Management, you’ll find what works best for your subscribers to really drive CLTV, retention, and brand loyalty.

We’re here to help

If you are reviewing your pricing and revenue strategy, get in touch to arrange a demo of how we can unlock all the tools needed to succeed now, and in the future.

Contact our helpful team; Telephone +44 844 873 1418 or visit our contact us page.