At the 6th Annual INMA Media Subscriptions Summit conference in Stockholm, we had the pleasure of hosting over 150 conference attendees at our sold-out workshop session, Best Practices in Optimizing, Retaining and Expanding Subscribers. At the session, experts from FT Strategies, Mather Economics, Mediahuis, BBC and Forward Publishing joined Aptitude subscription experts Ana Lobb and Charlotte Parker to discuss how media companies can thrive in the age of economic uncertainty.

As part of the workshop, we ran a few poll questions to assess the priorities, concerns and investment intentions of the group.

In this blog, we dive into the responses and talk to Charlotte and Ana about their thoughts on what these answers show.

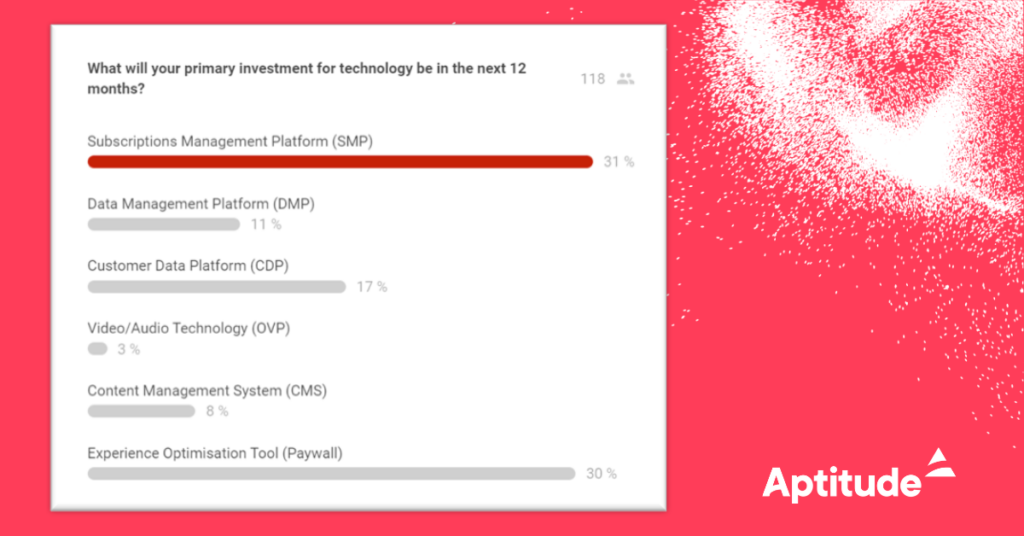

Question 1: What will your primary investment for technology be in the next 12 months?

So, it was interesting to see that the bulk of respondents were either looking at replacing their subscriber management platform or their experience optimization tool – essentially their paywall – with the rest split among a variety of tools.

In the workshop, the conversation touched a lot on this idea of best-of-breed solutions and the value of looking at modular technologies and creating an open data framework. If you are investing in a subscription management platform that gives you that broad control while also letting you bring in all of these new and exciting MarTech tools, that’s the best of both worlds.

Aled John, Director, Deputy Managing Director at FT Strategies spoke about the build vs. buy debate and the fact that as data strategies become more sophisticated, the industry is leaning away from expensive all-in-one tech solutions towards more flexible best-of-breed architectures. The key here is prioritizing a flexible architecture that supports continuous change. His point was that when selecting core tools such as subscriber management systems, focus should be paid on the ease of integration with other tools.

Increasingly, tech vendors are creating strategic partnerships to solve various challenges for publishers which could include MarTech and paywall tools, data modeling or Payments, CRM, distribution or CMS. Many of these proactive integrations can be quickly leveraged to avoid delays and complex integration projects each time a change is required. Transformation is dead, long live continuous change!

At Aptitude, our approach is that we want our platform to be as open as possible so that we can allow our clients to quickly plug-in tools from our partners like Mather for dynamic pricing, Minna Technologies for churn reduction, and a host of others.

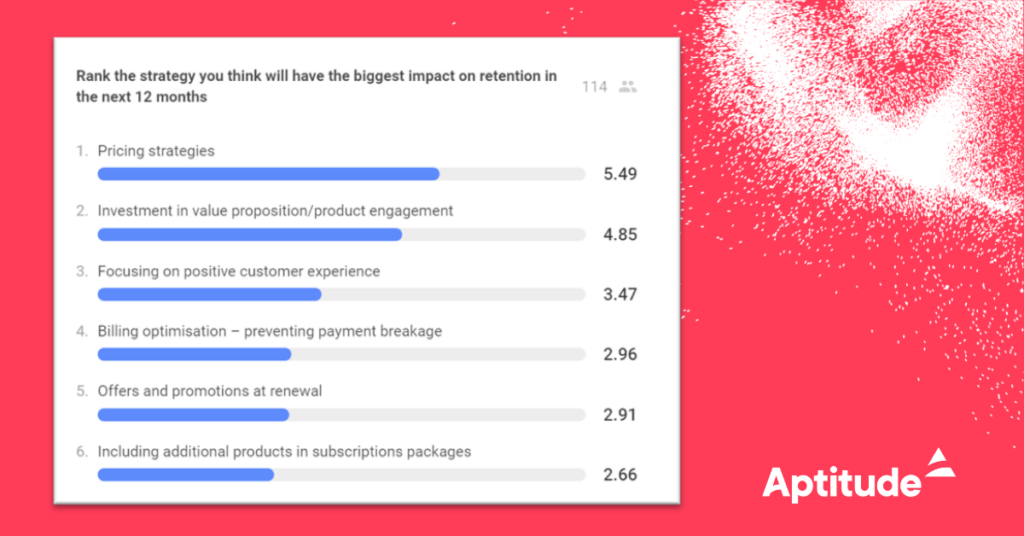

Question 2: Rank the strategy you think will have the biggest impact on retention in the next 12 months.

Throughout the conference, there was this overarching, significant concern around churn – not surprising given both the rapid subscription growth during Covid and the current cost-of-living pressures that are pushing customers to pull back on discretionary spending.

We talked to a lot of attendees who are looking to understand the different types of churn, how to access churn data analysis and then format some sort of strategy to counter it. I was actually glad to see ‘pricing strategies,’ ‘investment in value proposition/product engagement’ and ‘developing positive customer experiences as the top three responses as I think those are really areas where companies can get proactive about retaining their subscriber base.

Given the popularity of pricing strategies, it was great to have Liesbeth Nizet, Managing Director at Mather Economics in the workshop with us to help talk to the increasing role dynamic pricing is playing in subscriptions. We asked her what she was seeing in terms of the role of dynamic pricing in helping reduced churn and she remarked, “We see with our publishers that there is a 40%-50% reduction in price-related stops from targeted pricing versus across-the-board price increases. This obviously has a very large impact on the net revenue yield from a price increase.” Clearly, this is an area media organizations need to be paying attention to.

Watch: Pricing strategies to maximize growth and retention (Aptitude & Mather Economics)

I’ll add that the fact ‘investment in value proposition/product engagement’ ranked number two is not surprising to me and it’s great to see. I think the publishing industry especially is looking to shift from a heavy advertiser-based revenue model to leaning in more toward Subscription first strategies in response to advertisers who are less inclined to invest in anonymous user impressions. I think that ranking of investment in value proposition is really a testament to that.

I think the other thing that came up around this poll question is the ability to automate some of these churn-reduction activities. I spoke with an attendee from a French publication, and she was talking about using different message scripts in her call center to try and retain customers.

I think the other thing that came up around this poll question is the ability to automate some of these churn-reduction activities. I spoke with an attendee from a French publication, and she was talking about using different message scripts in her call center to try and retain customers.

We ended up speaking about how our subscription management platform automates the application of these messages within self-care pages. Same with the billing side, she was hand-cranking a lot of the billing to try and prevent losing subscribers when a lot of that can be improved and automated through billing optimization and turn the churn campaigns. At the end of the day, media companies saw significant growth following the pandemic. They had a captive audience. So, there’s a really strong focus on what can we do now to retain these subscribers.

And as Charlotte said, this move away from just looking at unique clicks and website hits towards a more recency/frequency/volume metric is forcing media companies to make sure their content is as engaging as possible. One of the things that came up was around diversity where we were talking about how adding underrepresented voices can be a quick win in terms of boosting engagement. Can you add more women journalists for example?

Download: 5 steps to payment optimization and churn management

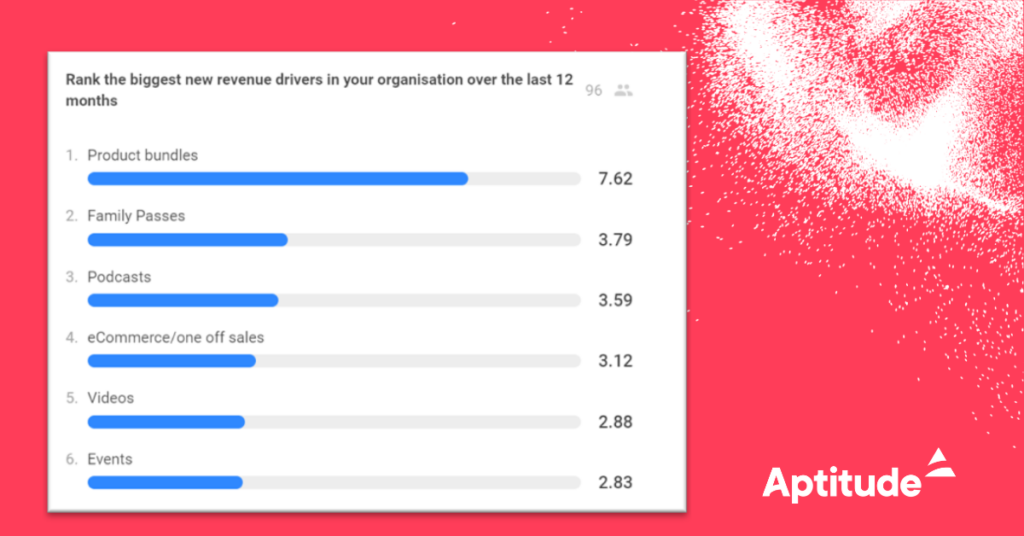

Question 3: Rank the biggest new revenue drivers in your organization over the last 12 months.

Over the course of the conference and during the workshop, we heard from a couple of different publishing groups on how they are looking to innovate product bundles with several mentioning the idea of a ‘mega bundle’ and its ability to prioritize engagement metrics across brand portfolios.’ Imagine a media house on top of various different media brands looking at bundling up a cross-section of every single one of their titles into one giant bundle that users can pick and mix the bits that they want from that bundle.

Over the course of the conference and during the workshop, we heard from a couple of different publishing groups on how they are looking to innovate product bundles with several mentioning the idea of a ‘mega bundle’ and its ability to prioritize engagement metrics across brand portfolios.’ Imagine a media house on top of various different media brands looking at bundling up a cross-section of every single one of their titles into one giant bundle that users can pick and mix the bits that they want from that bundle.

Our MediaHuis panelist, Koen Meeusen, mentioned that they’ve looked at all of their different titles – I think there are 33 national and local – across digital and print and they’ve put everything in one package and allowed users to pay a certain amount and get access to all or a subset of content.

Our panelist, Roger, from BBC talked about his plans to leverage community-based propositions as a way of adding additional value to the product which I thought was really interesting.

Of course, what this then requires is complete flexibility on the part of your subscription management solution to facilitate this broad variety of product bundles that customers can choose – supporting the pricing, access, etc.

At the end of the day, the takeaway is there isn’t a one size fits all winning formula and to succeed, you need full agility. So, when you are thinking about what you’re going to do and the tools that you’re going to pick, pick solutions that allow you to test, iterate and learn with different pricing and different contracts, different business models – without needing to involve your technical team quickly – and easily. A businessperson or a marketeer should be able to log into the platform, create a new package, new price point, a family pass, or a bundle, then launch it and test it within a matter of hours.

At the end of the day, the takeaway is there isn’t a one size fits all winning formula and to succeed, you need full agility. So, when you are thinking about what you’re going to do and the tools that you’re going to pick, pick solutions that allow you to test, iterate and learn with different pricing and different contracts, different business models – without needing to involve your technical team quickly – and easily. A businessperson or a marketeer should be able to log into the platform, create a new package, new price point, a family pass, or a bundle, then launch it and test it within a matter of hours.

This industry is ever-changing so what matters is flexibility and speed to market. It was great to be able to share the story of our German publishing client, Aschendorff Group, and how they used our subscription management platform to reduce the time it takes them to bring a product to market by 97%!

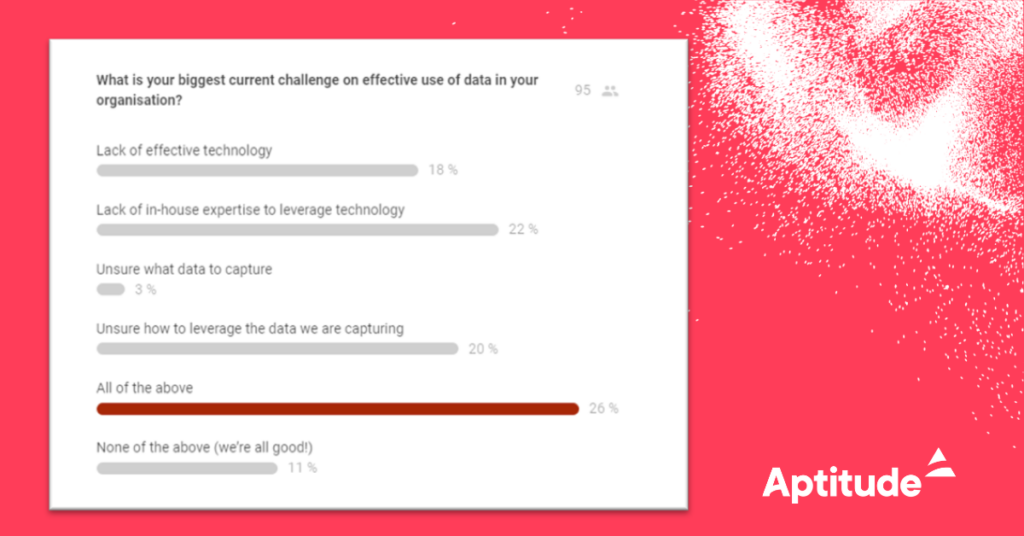

Question 4: What is your biggest current challenge on the effective use of data in your organization?

This data question is interesting. The general feeling from workshop participants was that everyone knows that they need data and know that they should have a first-party data strategy. Some have maybe made some steps towards defining a more strategic approach. But actually, many have no idea how to actually make it happen – how to apply focus to it, how to collect data properly, how to aggregate data, and how to use data. And the overall consensus was this sense of a lack of expertise in-house since typically these groups don’t really have data analysts or business intelligence-type roles.

This data question is interesting. The general feeling from workshop participants was that everyone knows that they need data and know that they should have a first-party data strategy. Some have maybe made some steps towards defining a more strategic approach. But actually, many have no idea how to actually make it happen – how to apply focus to it, how to collect data properly, how to aggregate data, and how to use data. And the overall consensus was this sense of a lack of expertise in-house since typically these groups don’t really have data analysts or business intelligence-type roles.

Many also lack the technology to get that single customer view – to pull together all of their different platforms into one place so they can drive some effective kind of data intelligence based on all of those different ports that they’ve got. This is why you are seeing Customer Data Platforms (CDP) becoming a huge trend in the market. The promise of one single view of all of your customer data in 1 place is huge.

I think the overarching theme here is focus and alignment. We’ve seen the industry go from the big data initiatives to starting to get the data capture infrastructure in place. Now we’ve all got tons of data. What do we do with it? How do we action it? And that’s not a new thing, but what is new is that there are more and more consultancies, people like FT Strategies who were on our panel who are starting to provide more focused benchmarking on what is possible and create a bit more structure around using data to drive revenue.

I think the overarching theme here is focus and alignment. We’ve seen the industry go from the big data initiatives to starting to get the data capture infrastructure in place. Now we’ve all got tons of data. What do we do with it? How do we action it? And that’s not a new thing, but what is new is that there are more and more consultancies, people like FT Strategies who were on our panel who are starting to provide more focused benchmarking on what is possible and create a bit more structure around using data to drive revenue.

Thank you to all our workshop attendees and to INMA for a fantastic conference. If you want to continue the conversation, please reach out to ana.lobb@aptitudesoftware.com or charlotte.parker@aptitudesoftware.com.