In today’s rapidly evolving business landscape, finance departments are no longer just about crunching numbers; they are becoming pivotal strategic advisors empowered by cutting-edge technologies. One of the most revolutionary approaches in this industry is Autonomous Finance. But what exactly is Autonomous Finance?

Defining Autonomous Finance

While the exact definition differs slightly, Aptitude Software defines Autonomous Finance as a self-learning and self-improving finance function, where tasks are optimized and intelligent, systems are efficient and interoperable, and an enterprise-wide data platform supports real-time insights, enabling finance to be a strategic and trusted advisor to the business.

Let’s break it down

To comprehensively understand Autonomous Finance, it’s important to break down the definition into its fundamental components. Autonomous Finance is characterized as a self-learning and self-improving finance function. This means operations are not just automated but are also capable of adapting and optimizing themselves over time. This dynamism allows the finance function to continuously improve without manual intervention, using algorithms that learn from data patterns and outcomes to enhance decision-making processes.

The second defining aspect of Autonomous Finance is the efficiency and interoperability of systems. This implies a technological infrastructure where various financial systems and tools seamlessly communicate and operate together without silos. Such interoperability facilitates a unified platform approach, crucial for real-time data processing and accessibility, thus enabling quicker and more accurate financial insights.

To further understand how organizations are adopting principles of Autonomous Finance, our Autonomous Finance Benchmark Research, involving 1,700 senior finance and IT leaders across multiple regions and industries, provides critical insights. A key finding from our research relates to financial software procurement preferences. We discovered that 75% of respondents prefer a best of breed/right for the need approach over a single vendor solution. This highlights a significant shift towards flexible, interoperable systems that allow for better data integration and more responsive financial operations, aligning well with the autonomous, efficient, and integrated characteristics essential to Autonomous Finance.

Learn more: Technology ecosystems are greater than the sum of their parts – Aptitude Software

Supporting these characteristics is an enterprise-wide data platform that not only consolidates data across the organization but also ensures it is available in real-time. This capability is vital for enabling finance functions to act as strategic advisors, offering insights that are timely and reflective of the current business environment, rather than being merely retrospective.

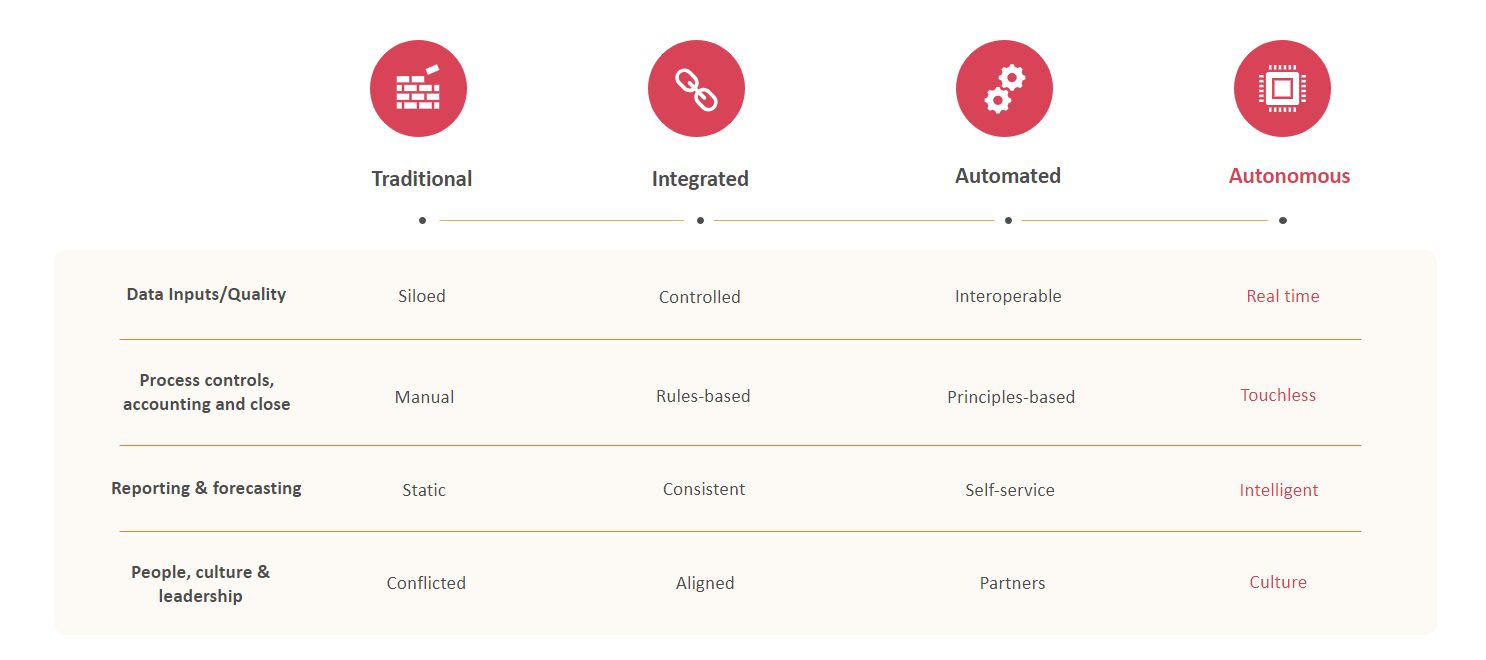

At Aptitude, we’ve segmented the journey to Autonomous Finance into four progressive stages, reflecting an increase in the maturity level of the integration and automation of financial operations:

- Traditional: Here, data is siloed, processes such as controls, accounting, and close are manual, reporting is static, and the organizational culture may exhibit resistance to change, often leading to conflicts.

- Integrated: At this level, data management becomes controlled, processes are governed by strict rules, reporting becomes consistent, and there’s better alignment in the organizational culture and leadership towards embracing technological integration.

- Automated: The focus shifts to making data interoperable across systems, automating principles-based processes, enabling self-service in reporting and forecasting, and fostering a partnership culture within the team.

- Autonomous: The pinnacle of this journey is marked by real-time data processing, touchless transactional processes, intelligent reporting, and a culture deeply grounded in the ethos of innovation and strategic advisement.

At our recent Autonomous Finance event in London, Mark Aubin, SVP of Product and Market engagement at Aptitude Software, highlighted several insights from our comprehensive benchmark survey conducted to understand the current landscape and adoption of Autonomous Finance. According to Aubin, “Autonomous Finance is more than just a sexy buzzword. It actually means something.” He explained that the progression from traditional to Autonomous Finance involves significant shifts not only in technology adoption but also in cultural and strategic alignment within organizations.

From the survey, it’s evident that while many finance teams aspire to reduce their time spent on manual processes and increase their strategic contributions, gaps still exist, particularly in fully automating finance functions. While finance teams see themselves as leaders in digital transformation efforts, they still recognize there are significant hurdles in data management, automating the financial close and the full utilization of AI.

Aubin’s discussion also delved into how these themes are manifesting across different regions and industries, noting variations in AI adoption and the integration of advanced analytics into financial operations. The overarching goal, as shared by Aubin, is for finance to not only optimize current processes but to be forward-looking, using insights to drive business strategy proactively.

By exploring each stage in the journey toward Autonomous Finance and expanding on the core elements of its definition, businesses can better understand their current position and what steps they need to take to evolve into strategic, data-driven advisors capable of leveraging the full potential of Autonomous Finance technologies.

Aptitude Fynapse – The Autonomous Finance platform

At the heart of an Autonomous Finance function is Aptitude Fynapse, a sophisticated finance data management and accounting platform for CFO’s that want to increase productivity, lower costs, and transform the finance function into AI-powered value creators for their business. By automating manual tasks and the application of accounting rules, Fynapse not only delivers a unified view of finance and business data but also integrates advanced AI capabilities to drive insightful decision-making. This empowerment allows finance teams to evolve beyond traditional roles and become strategic advisors.

Key benefits of Aptitude Fynapse

User experience: Fynapse puts control in the hands of finance teams with its self-service capabilities, significantly reducing dependency on IT.

Rapid implementation: Unlike traditional systems that take months or even years to deploy, Fynapse can be up and running in just days, accelerating the time to value.

Seamless integration: The platform offers open and configurable solutions, ensuring substantial time and budget efficiencies.

Unmatched performance: Fynapse is the fastest solution in the market, providing real-time data, reporting and advanced close processes.

Data utilization for AI: Fynapse provides a unique, singular view of data that lays the foundation for robust AI applications.

Experience Autonomous Finance with Aptitude Fynapse

To truly understand how Autonomous Finance can transform your finance function into a dynamic, strategic business unit, we invite you to book a demo with an Aptitude expert and explore the capabilities of Fynapse. Discover how you can free your finance team from traditional constraints and enable them to drive growth, efficiency, and sustainability within your organization.

Book your Fynapse demo today and step into the future of finance!