Make Your Checkout Process Lightweight, and Prevent Abandoned Carts

It’s already the end of January 2020. How are those resolutions going? A new year gives us a focus to lean up, get better, faster, and stronger – to improve on the previous year.

Key Takeaways

- The problems with long checkout processes and abandoned carts

- Streamlining checkout and purchase journeys

- Using Express Checkouts to minimize the amount of data required for payment

- Using Alternative Payment Methods to boost conversion rates

For many of us it’s about personal goals, but it’s also a great opportunity to look at our product solutions. Is your signup flow as fast and efficient as it could be? Are potential new customers getting frustrated at having to jump through too many hoops? Are the accepted payment methods in line with customer expectations, and effective enough to maximize conversion?

Most consumers want as little friction as possible when viewing content, so as content producers, it’s important to bear that in mind when we’re interrupting the consumption process for payment or personal details. Building a seamless checkout journey is about eliminating distractions, providing all the details the customer requires and providing an accurate map of the journey so the customer knows exactly where they are in the process.

Filling out long, complicated forms can be a barrier – but in some cases, a regulatory requirement -, and designers put in a lot of time and effort to create the most streamlined approach possible during the payment process. what if we put the registration element after payment? Instead of typical flows that capture the customer’s personal details first and treating data capture with a higher importance than payment and access, is it more effective to provide the customer with their goods first, and request personal details later? Let’s discuss…

Express Checkout – The Quickest Possible Checkout Process?

The concept of an Express Checkout does exactly this. A visitor can be browsing a site and viewing articles or content, but at some point will be prompted to sign up with payment details, typically via a paywall. At this point, the consumption has been interrupted, so it’s important to make this process as seamless as possible to convert this visitor into a paying customer so they can get back to consuming. Your content has already convinced them, but a poor/time-consuming checkout experience can change their minds.

The concept itself involves typically taking just the email address and payment details of the user, prompting them to complete their details and create/update an account later; much like a guest account. As their email address has been captured, it’s possible to contact them further with promotional offers and/or to encourage the customer to complete their details.

The result is that the customer has been able to purchase access whilst minimizing the disruption to the consumption of the content, whilst the publisher or content provider has obtained a new customer, and only needs to convince them to stay, rather than to walk through the door in the first place.

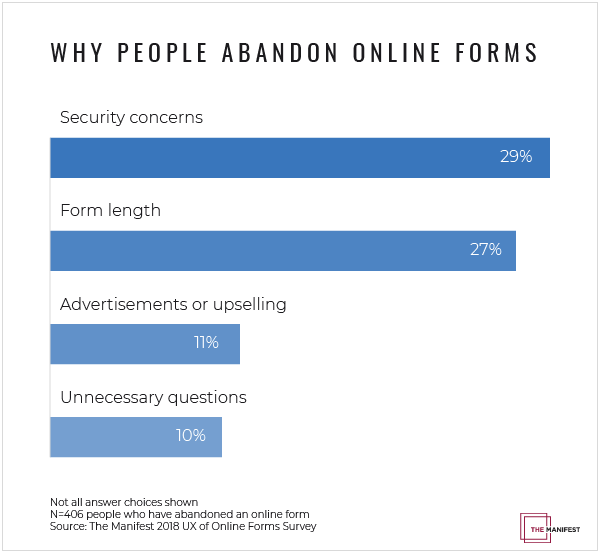

Graph by Michelle Delgado, The Manifest (https://themanifest.com/web-design/6-steps-avoiding-online-form-abandonment)

There are further opportunities to decrease friction further by combining short forms with Alternative Payment Methods (APMS), meaning a potential customer can sign up by just using a biometric trigger and their email address.

Alternative [Fast] Payment Methods (APMs)

Despite its speed and convenience, the drawback of this solution is that the customer is taken away from the viewing experience to obtain their credit card details, and whilst it’s a vitally important security element, 3D Secure prompts can be a frustrating additional step, especially with SCA lingering. Thankfully, many consumers are turning to wallet technology and other additional payment methods, such as carrier billing to facilitate payments. PayPal has been a market leader for many years in the wallet space, but the likes of Apple Pay, and Mobile Pay are quickly becoming a preferred method of in-app and online payments.

Offering alternative payment methods – typically anything that isn’t a card – means the customer isn’t digging around for their card, and the process of signing up can continue unimpeded, and better still, potentially increased with the likes of Apple Pay only requiring a biometric fingerprint to authorize a payment.

Potential customers are adopting payment wallets that already contain there personal details to streamline the payment process. Whilst the likes of PayPal has been around and servicing this need for some time, other vendors are now catching up, even to the degree of sharing allowing customers to use accounts – and payment wallets – across different sites and providers. In the search for simpler, faster checkout processes, this trend is only likely to increase.

There’s an increasing expectation with potential customers that a checkout process can be completed entirely within their device, with more and more people using their mobiles, smart speakers and other emerging technology to make purchases over the traditional buy-then-pay model.

3DS and Future Considerations

It’s important to note that with the upcoming changes in Strong Customer Authentication (SCA) requirements in Europe, and the release of 3D Secure 2 to meet these requirements, solutions that use fast checkout processes are likely to see some key changes. It’s unlikely to affect publishers outside of the EU, i.e. the likes of the US or Japan, but certainly something that EU content publishers need to consider when thinking about Express Checkouts. It may mean that alternative payment methods, such as wallet or carrier billing, may become more prominent to ensure the experience is as frictionless as possible.

Summary

MPP Global offer Express Checkout functionality as a method of capturing payments and converting visitors to customers in a single step, and with minimal required details. Subscription Management supports a variety of cardless payment solutions (APMs), giving the greatest possible flexibility and variety to customers when choosing to pay or subscribe to your content.

Stick to those resolutions and make 2020 work harder, better, faster and stronger for you! Talk to our team about how we can help you optimize your checkout process today.

Sources:

Rachel Delgado – 6 Steps to avoiding online form abandonment (https://themanifest.com/web-design/6-steps-avoiding-online-form-abandonment)

We’re here to help

If you are reviewing your checkout, conversions and eCommerce strategy, get in touch to arrange a demo of how we can unlock all the tools needed to succeed now, and in the future.

Contact our helpful team; Telephone +44 844 873 1418 or visit our contact us page.