For large, multinational companies, a shift to the new leasing standard (IFRS 16/ASC 842) will cause unforeseen impact.

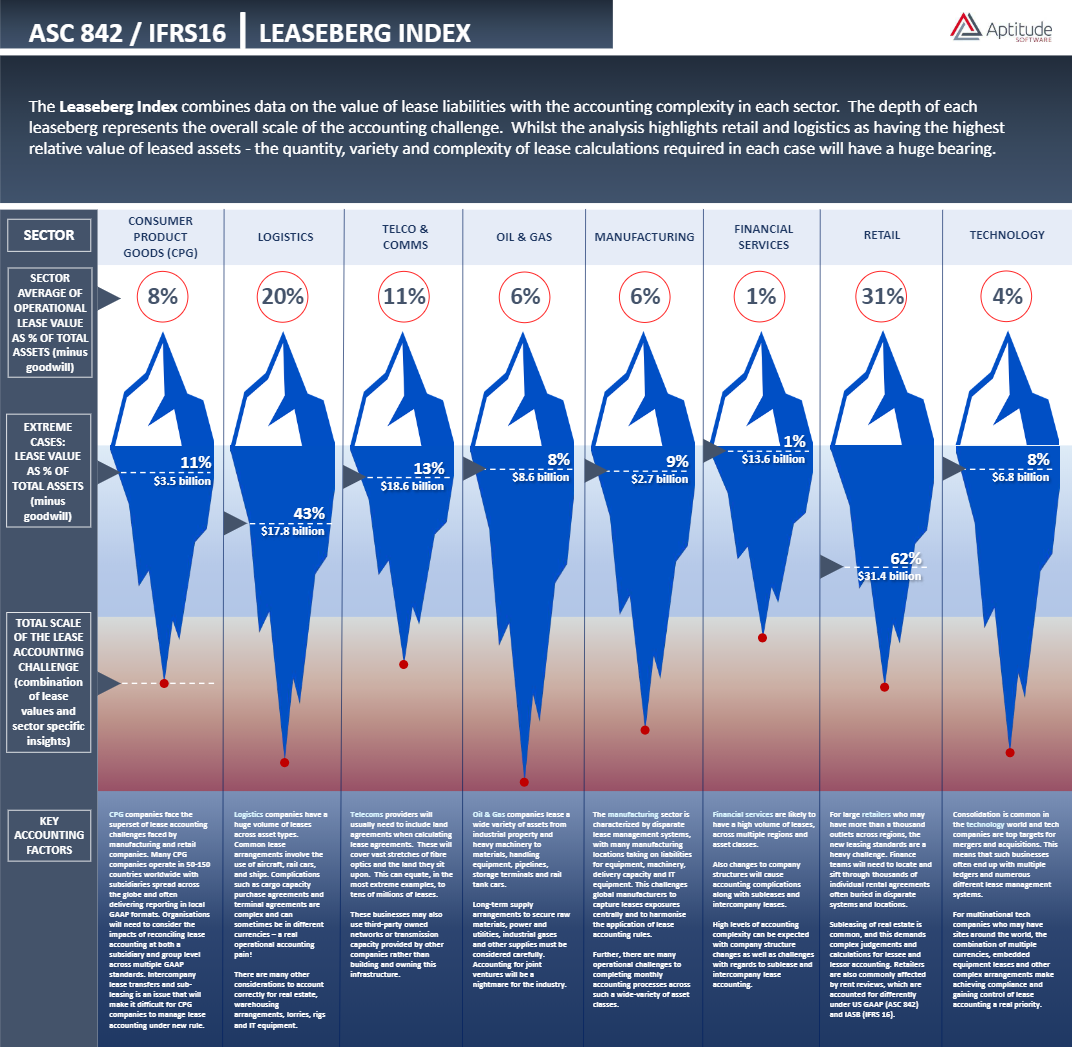

Aptitude Software is today announcing the ‘Leaseberg’ index to highlight the relative value of leased assets by sector and the accounting challenges that lie below the surface.

For multinational companies, operational leases represent a material proportion of a companies’ balance sheets.

Whereas lease commitments have always been ‘in view’ in the form of disclosures, analysts and rating agencies have always had to add in these commitments in each of their models and perform valuations using their own assumptions about these commitments. The new rules force companies to precisely account for the ‘actually expected future cash flows in the statement of financial position, in terms of both precise amounts and timing.’ The change will likely affect financial ratios such as the ratio of net debt to EBITDA (gearing).

As the massive value of off-balance sheet liabilities is brought into view, CFO’s must apply accounting consistently and appropriately across a huge value and volume of leases.

ASC 842 and IFRS 16 are accounting issues, not lease management projects. There are some real complexities in applying the new rules for things such as sub-leases, lease transfers and multi-GAAP accounting.

Not getting lease accounting right could sink ships.

As financial accounting experts, we stand to help steer CFO’s through this icy patch.

See Aptitude’s IFRS 16 and ASC 842 software.