The new lease accounting standards, IFRS 16 / ASC 842, will bring trillions of dollars of lease liabilities onto company balance sheets and trigger significant accounting changes when they take effect in December 2018 / January 2019. This is the first in a series of blogs where we look at various complex lease types and the required accounting treatments under the new lease accounting standards.

What is a sublease?

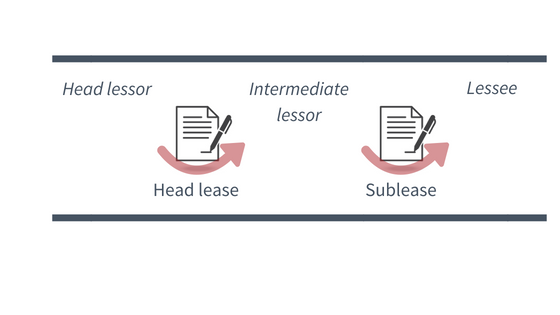

A sublease originates when a lessee decides to rent out an asset they already lease, to a third party. The third party must have the right to control the use of the underlying asset for a period of time in exchange for consideration, thus meeting the definition of a lease. When this happens the original lessee, often called the head lessee or intermediary lessor, must determine how to account for this change.

Accounting for subleases under the new standard

Accounting for subleases under the new standard

When making accounting decisions on how to account for a sublease, there are a few things to consider.

Initial evaluation

Entering into a sublease is a significant event that is within the control of the lessee, subject to the terms of their lease. Since this action could affect things like the potential to exercise an option, it is advisable for the head lessee to reassess the lease term of the head lease before signing the sublease. As is the case under IAS 17 and ASC 840, subleases must be classified as either a finance or operating lease.

Follow the liability

In some cases, the sublease is a separate lease agreement. In other cases, a third party assumes the original lease, but the original lessee remains the primary obligor under the original lease. Exactly how the sublease is accounted for by the head lessee ultimately depends on who maintains primary liability under the head lease. If the intermediate lessor maintains primary liability, they will continue to account for the head lease on their balance sheet as a lessee and account for the new sublease as a lessor. If the head lessee is relieved of the primary obligation of the original lease but maintains a secondary liability, they would account for the transaction as a termination of the original lease and recognize a guarantee obligation.

De-recognition & Impairment requirements

One potential area of complexity around subleases has to do with the concept of de-recognition. When a lessee decides to sublease an asset and it’s classified as a finance lease, they must de-recognize the right of use asset attached to the head lease.

The tests applied to a sublease to determine whether it is a finance lease differ between IFRS 16 & ASC 842 and mean that de-recognition is likely to be a more frequent requirement under IFRS 16.

Accounting challenges under the new standards

The new sublease accounting rules are a significant departure from those outlined in the current IFRS 16 standard which were already quite complex. We are seeing the following accounting challenges around subleases:

- The intermediate lessor typically accounts for the head lease and sublease as separate contracts and will need to apply both lessee and lessor accounting models.

- The sublease classification tests for IFRS 16 differ from the regular lessor classification tests.

- Modifications to either the head lease or the sublease must also account for the impact on derecognition where appropriate.

- Multiple subleases can be associated with one head lease.

Final thoughts

IFRS 16 and ASC 842 pose significant challenges not only from a systems and data perspective but also in the application of accounting. We believe that the accounting complexities of the new lease standard are under appreciated by lease administration vendors. Contact us to walk through some complex lease accounting scenarios that may be creating headaches for your organization. Visit out product page to find out more about our lease accounting solution.