There is a lot that the OTT and Publishing industries can learn from each other in terms of acquisition strategies, that with a bit of adaptation, could result in improved customer signup in unexpected ways.

Ultimately, both industries focus on selling content direct to consumers. And there is significantly more crossover than there would have been 10 years ago, as video and online media have become the most common form of content consumption.

OTT Market growth is expected to grow by 14% in 2021 and new digital subscription orders rose 420% in 2020 against the previous year, providing the impetus for organizations on both sides to take advantage of this period of continued growth, and many of the strategies of one industry can be adapted and applied to the other.

Key Takeaways

- Day Passes can be used to encourage short term subscription signups for events

- Physical and Digital provisions are no longer silos in themselves and are forming parts of a more unified strategy

- Payments and Subscription dates can be disconnected for greater flexibility

- Partnering with other businesses and services offering third-party discounts and gifts is still a solid strategy

- Offering the ability to pause subscriptions rather than cancel outright can reduce churn

- Bundling products together to form more focused packages can be more enticing than the all-you-can-eat approach

- Streamlining registration and payment journeys is critical to maximizing conversion

Day Passes and Event-Based Access

One-off events are common within the Sports OTT space, particularly as much of the content is one-off such as major sporting events., Sports OTT has used the pay-per-view model on event content for a long time, and Now TV have been using their Passes model since 2012.

The equivalent model in publishing is the range of subscription types that are on offer to customers. While the ‘day pass’ is not a concept widely adopted in publishing, other strategies such as student access, VIP packages, corporate access, and access for a fixed length of time. With video becoming a bigger slice of the overall content strategy in publishing, there are opportunities to take lessons from OTT channels.

iFollow from the EFL allows fans to buy match passes for their favorite teams. (Souce: https://www.efl.com/ifollow/)

Day Passes could easily be used to provide a time-limited entitlement to specific content, which captures the customer registration data at the same time, opening the door to targeted marketing further down the line. It also gives a strong insight into the content that resonates with that customer, which is powerful acquisition data.

Free Content / Freemium alternatives

Another common strategy in the publishing sector is to provide a certain amount of content for free, such as a limited number of free articles, or content types/genres that is free to unregistered customers – the well-documented ‘freemium’ approach. Meanwhile, in OTT and SVOD, the general rule is to have content locked behind a paywall or have all content available for a limited free trial period – a commercially restrictive ‘all or nothing’ approach.

An alternative value exchange would be to provide a metered registration wall; offering customers the ability to watch selected content for free in return for creating an account and sharing their personal details. ‘Free Weekends’ is another example often used in the videogame industry where specific titles are available for limited periods in return for customer signups, such as time limited access to games on the Playstation network, Xbox Live, and Steam.

US-based SVOD service movieSpree ran free weekend offers on their content in 2020 (Source: https://www.mediaplaynews.com/tvod-service-moviespree-launches-new-promotion-with-free-content/)

For services that do not provide a free trial, this can help entice new customers who get the opportunity to see the quality of the service. For example, 58% of US broadband households who trial a OTT video subscription service convert to paying subscribers. For churned customers, it is an opportunity to bring them back in. It also generates an opportunity to increases customer loyalty through other strategies.

Payment and Fulfilment Scheduling

There are occasions, particularly with digital and physical subscription items, where the payment and order fulfillment need to be on different days. The typical subscription model works by charging the customer in advance, then granting access from that point to the next billing date. The most common example in the publishing sector is to be able to deliver physical content subscriptions at the time they are printed, but detaching billing dates from subscription dates gives customers more flexibility when purchasing a subscription.

There is a key advantage to this approach; customers who sign up for a service on a day corresponding to other outgoings can have more convenient billing dates for their personal circumstances, which can reduce churn. Another practical use is where content such as a movie release is due on a different day to the billing cycle, meaning a customer can pay in advance for this content.

Subscription Holidays

A common scenario within the publishing sector, particularly those publishers that operate physical delivery, is where customers wish to ‘pause’ their subscription for reasons such as going on holiday, or a financial decision. These customers do not want to churn, so an alternative for publishing is the concept of a subscription holiday – access and payments are paused for a set length of time agreed by the customer and the provider.

OTT, on the other hand, is either active or inactive. Customers who need to make this decision must typically cancel their subscription and then remember to reactivate – once churned, they may choose not to come back at all. There are some services, particularly sports services such as BT Sport and Sky Sports, which offered to pause subscriptions in part of 2020 due to a lack of sports events. In the case of BT Sports, the payments could be halted, or donated to the NHS. Other sports-based OTT services offered payment holidays to their customers during this time.

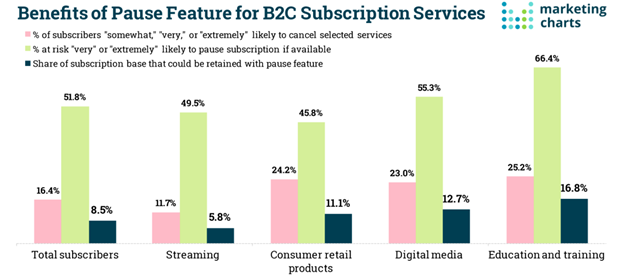

For OTT Sports, this is helpful for retaining customers who would otherwise churn in the off-season; customers can be at ease knowing their subscription and billing will only be active when they need the service. SVOD providers can retain customers who are typically only pausing their subscription for a brief time, such as going on holiday, will see value in a service that provides access when they need it. In a 2020 study, nearly 50% of US streaming subscribers would prefer to pause their subscriptions if this functionality was available, and 55% of digital media consumers felt the same way.

Across the subscription landscape for US consumers, over half would prefer to pause a subscription rather than cancel altogether. (Source: https://www.marketingcharts.com/brand-related/brand-loyalty-113074)

Product Bundling

Bundling is the process of combining multiple products and offering them in a single package. Using customer data insights and personalization solutions such as Zephr, businesses can get clear insights into the reading and viewing habits of their customers. This data can be used to identify products that often perform well together, and those products can be offered in a package to the customer dynamically as an acquisition incentive.

For publishing, this could be discounted access to certain articles based on topic, a group of magazines, or relevant discounts on third-party services. For larger OTT providers, this can be access to specific categories such as kids shows or movies. There’s scope to be even more specific and form ‘lite’ subscriptions, such as a special bundle for films in the action category, or discounted access for wildlife documentaries.

Express Registration and Checkout

Netflix is a model example of easy signup; an email address, a password, and the customer account is ready. Amazon and Now TV both have simple sign-up pages to get customers viewing their content, quickly. The key element is reducing the amount of personal data collected at the point of sign-up. The typical registration flow will offer email and password, or Social Sign On; long signup forms are rare in the OTT space.

Publishing can stand to learn from this lesson; customers expect as frictionless a sign-up process as possible. Where metered registration walls are used, it is a good idea to put the single sign-up process in a prominent place, using SSO and email/password only. Ensuring the registration and payment appears on a single page also reduces time and friction, which can increase the acquisition rate. There is a consideration within the European Economic Area; Strong Customer Authentication (SCA) is an expectation of multi-factor authentication within the EEA when processing payments, so organizations that seek to streamline payment journeys. Reducing the length of signup forms can increase conversion by almost 20%, so it’s certainly a worthwhile consideration.

Netflix request only an email address to get started (Source: https://www.netflix.com/gb/)

Conclusion

As content types diversify, and consumer expectations of media companies change, there is a wealth of knowledge that can be shared between the publishing and OTT industries to encourage customer signups and boost customer lifetime value. OTT providers can learn a lot from the offer and trial strategies of the publishing sector, moving away from the decades-old ’30-day free trial’ model.

On the other hand, OTT and SVOD services, particularly within sports, have shown that ‘day passes’ and other time-limited access controls for events can acquire customers at least in the short term – and once their registration is captured, their data can be analyzed, and further acquisition incentives can be presented.

For both sectors, acknowledging that content does not have to be an ‘all or nothing’ approach, using data to personalize offerings and create bundled content tailored content, is a great way to win signups from customers. Physical and digital are no longer separate silos but are both key parts of the acquisition strategy. The popularity of video only continues to increase and is now an expected content format of any brand. The lines between OTT and Publishing are continuing to blur, and organizations that learn from this shift in expectation early stand to see major gains in customer acquisition.

More Information

MPP Global recently released “Subscriber-first Acquisition Strategies for Publishers” and “OTT Subscriber Acquisition Strategies for a New Reality”, two industry-specific playbooks containing industry insights, key strategies, and current analytics and trends from each industry. These comprehensive documents cover these strategies in more detail, with a focused approach to each industry.

We’re here to help

If you are reviewing your OTT or Publishing strategy, get in touch to arrange a demo of how we can unlock all the tools needed to succeed now, and in the future.

Contact our helpful team; Telephone +44 844 873 1418 or visit our contact us page.